How to Reduce Taxable Income in 6 Steps

With so many places your money can go, the IRS is rarely at the top of the list. Tax planning is one of the most critical parts of any financial plan because taxes can drag down the value of portfolios over time. We use many tax-optimization strategies to help our clients achieve their financial goals. Here are a few of our advisors' go-to strategies, so your money works for you, not the IRS.

Step 1: Understand the 2024 Tax Brackets and Where You Land

Strategically moving your money to lower taxes over time requires a thorough understanding of which tax brackets you fall into. To fully gauge where your tax planning should start, you need to identify your sources of taxable income and any projected taxable income for the upcoming year. This is especially crucial if you’re planning for any life-changing events, like retirement. Then, once you know the bracket you’re starting in for the year, you can begin looking into the deductions you qualify for to identify which ones can help reduce your taxable income.

Additionally, as the IRS has increased tax brackets to keep up with inflation, they have also increased all the standard deductions. Although the increases are minimal, they are important to note as you plan your itemized deductions for the year.

2024 Tax Brackets |

||||

| Tax Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

| 10% | Up to $11,600 | Up to $23,000 |

Up to $11,600 |

Up to $16,550 |

| 12% | $11,601 - $47,150 | $23,201 - $94,300 |

$11,601 - $47,150 |

$16,551 - $63,100 |

| 22% | $47,151- $100,525 | $94,301 - $201,050 |

$47,151 - $100,525 |

$63,101 - $100,500 |

| 24% | $100,526- $191,950 | $201,051 - $383,900 |

$100,526 - $191,950 |

$100,501 - $191,950 |

| 32% | $191,951- $243,725 | $383,901 - $487,450 |

$191,951 - $243,725 |

$191,951 - $243,700 |

| 35% | $243,726- $609,350 | $487,451 -$731,200 |

$243,726 - $365,600 |

$243,701 - $609,350 |

| 37% | $609,351 or more | $731,201 or more | $365,601 or more | $609,351 or more |

2024 Standard Deduction Amounts |

||||

|

Year |

Single |

Married Filing Jointly or Surviving Spouses |

Married Filing Separately |

Head of Household |

|

2023 |

$13,850 |

$27,700 |

$13,850 |

$20,800 |

|

2024 |

$14,600 |

$29,200 |

$14,600 |

$21,900 |

Step 2: Consider Maximizing Pre-Tax Retirement Plan Contributions

While you are still working, you can contribute a significant amount of funds to your 401(k), up to $30,500 in 2024 if you're over 50 and up to $23,000 if you're under 50. You are missing out on a huge tax-saving opportunity if you aren’t contributing to the pre-tax source and getting the tax deduction. Pre-tax contributions made to your 401(k) lower your taxable income each year. There are certain rules about when high-income earners can and cannot contribute to a 401(k), so review your company’s benefits, the annual contribution limits, and see if there’s an opportunity for additional savings while offering tax benefits.

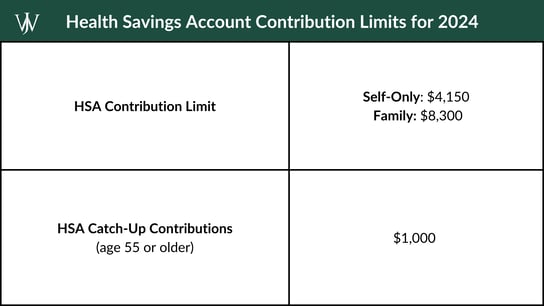

Step 3: Contribute the Maximum HSA (Health Savings Account) Amount

If your company offers a Health Savings Account, you have a triple-tax-advantaged benefit at your fingertips. HSA Accounts are only available to individuals covered by a high-deductible healthcare plan. HSA contributions are tax-free, their growth is tax-free, and if you use the funds for qualified medical expenses, the withdrawals are also tax-free. The HSA contribution limits are $4,150 for individuals and $8,300 for families in 2024. We commonly advise our clients to max out HSA contributions after other retirement accounts. However, contributions to your HSA can be deducted from your taxable income and help you get into a lower tax bracket.

HSA contributions for the year :

Step 4: Get a Tax Deduction for Charitable Giving

Many of our clients are passionate about the causes they support and the philanthropies they work closely with, and there are many strategies to help your funds go further for the causes you care about. If you currently take the standard deduction, discussing the strategies below with a CPA and financial advisor may help you to reduce your tax burden and ensure you have the proper documentation to accurately itemize your charitable efforts on your tax return.

Give to Charity Directly

When it comes to charitable giving, sometimes simply giving directly is the best course of action. It's crucial that whether you give cash from your wallet, swipe your credit card, or write a check, you document the amounts given to charitable causes and have records of your gift if you itemize it on your tax return as a deduction. Too often, taxpayers fail to keep proper records of their charitable efforts and end up paying the IRS additional funds for failure to substantiate the deductions they claimed in earlier years.

Do you make charitable gifts to the same organizations annually? If you know that you'll want to give to an organization over several years, you may be able to frontload your charitable contribution for several years to take a larger deduction during a high-income year. Frontloading gifts may require a certain level of liquidity and additional documentation so discussing the strategy with financial planning and tax planning professionals is advised.

Qualified Charitable Distributions (QCD)

If you are age 70 ½ or older and receive Required Minimum Distributions (RMD) from your retirement savings accounts, you may be able to designate your RMD to be distributed directly to a charity as a qualified charitable distribution. Reassigning your RMDs to charity can be a great way to lessen your taxable income while meeting RMD requirements, but it is a strategy that comes with red tape and rules that need to be abided by to receive the tax benefit.

Key Considerations for QCDs:

- If you do decide to make a QCD, it is key to remember to have your IRA’s custodian make the check payable to the charity and not to you as the owner. If the check is made out to you, there is no way to correct this mistake and the money will be deemed as part of your adjusted gross income.

- QCDs must be contributed to a public charity, not a private foundation nor a donor-advised fund.

- The current annual limit for QCDs in 2024 is $105,000 for individuals and $210,000 for couples

- A QCD can only be made from a Traditional IRA or an Inherited IRA where a beneficiary is over 70 1/2 years of age. You cannot make a QCD from a Simple IRA, SEP IRA, or 401(k), as these are considered employer-sponsored plans and are excluded from the rule.

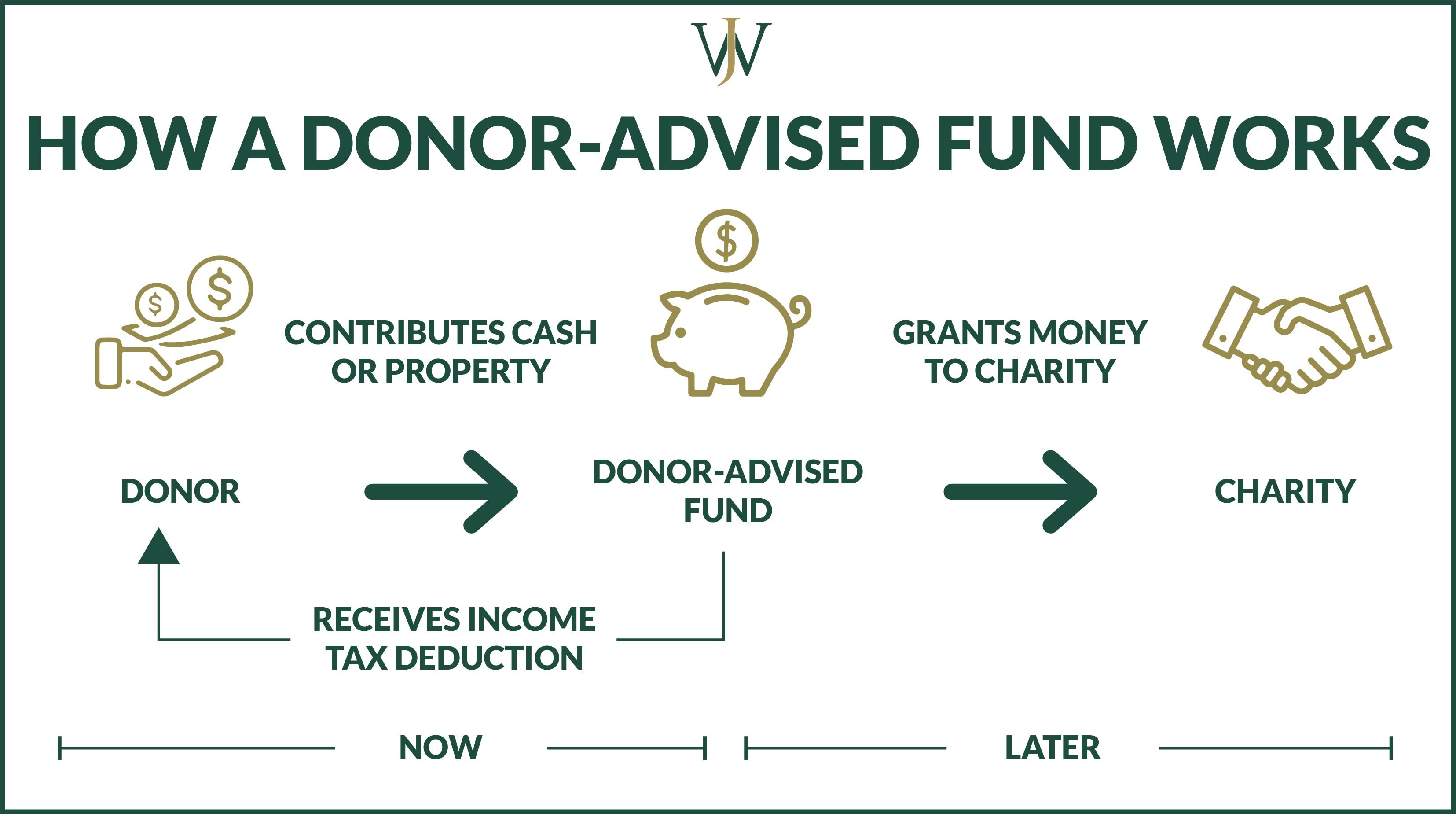

Donor-Advised Funds (DAF)

Through the investment options in a donor-advised fund, you can make your contributions to charity go further while minimizing your taxable income.

How Do Donor-Advised Funds Work?

You can make a large one-time donation to a DAF and receive a charitable deduction for the year the donation was made, assuming you properly document the strategy. Simplified, a donor-advised fund works in three simple steps:

- Select the fund you wish to contribute to

- Make ongoing irrevocable contributions to the fund and receive a tax deduction for each donation

- Invest for growth, determine your beneficiaries, and grant the money to charities of your choice

For example, if you contributed $100,000 to a DAF for 2024, you can receive the deduction on your 2024 tax return. You then can designate a charity to receive $10,000 per year for 10 years. Additionally, any earnings that accrue while invested in a DAF are not taxed and can provide additional funds to the charity of your choice!

Donate Low Basis Stock to Charity

If you have a stock with a substantial gain during a year you're in the highest ordinary income brackets, it may be beneficial to donate that stock to the charity of your choice. Whether directly or through a donor-advised fund, you can donate the stock (and the gains that come with it) to a charity, which is exempt from taxation. In doing so, you receive a charitable deduction for the full value of the stock (basis and gain), which is a total win-win.

Step 5: Use Your Investment Losses to Offset Capital Gains Through Tax Loss Harvesting

If you have an investment that has depreciated in value, it can offer surprising benefits. A strategy known as tax-loss harvesting enables you to sell the stock and use the loss to offset gains you made from selling appreciated stock earlier in the year.

Learn more about the Tax Loss Harvesting strategy here >>

Step 6: Use Roth Conversions in a Low Tax-Year to Pay Less in Taxes Over Time

If you have a traditional IRA, you can convert that IRA (or the after-tax portion of that IRA, depending on the type of IRA you possess) to a Roth IRA using a Roth Conversion.

A key advantage of Roths is that, since contributions are made after-tax, all earnings are distributed tax-free and there are no Required Minimum Distributions at age 70 ½. The downside is that all the tax is due on the conversion, and the pro-rata rule may cause additional taxes if not considered before starting the strategy.

Therefore, if you are in a low-income tax year, you may want to talk to a financial advisor to learn how to properly and tax-efficiently convert your IRA funds to a Roth. Specifically, a type of Roth conversion we often use with our high-income earners is a Backdoor Roth Conversion. A Backdoor Roth Conversion allows you to contribute non-Roth after-tax funds to a traditional IRA, and then roll those funds over to a Roth IRA tax-free. This strategy is beneficial when your income is too high to make direct contributions to a Roth IRA but you want to incur the benefits available by saving in one. However, many people try to do backdoor Roths on their own and incur unnecessary taxes along the way, so we recommend working with an advisor to ensure the strategy is maneuvered properly.

What Will You Do to Lower Your Tax Burden This Year?

It’s crucial to start early when tax planning so you can see its long-term impact. By identifying your income for now and in the future, you can create a plan that offers long-term health for your financial plan. At Willis Johnson & Associates, our experts work hard to ensure our clients receive the best tax planning and financial services available.

To jumpstart the achievement of your financial goals, fill out the form below to connect with our integrated team of wealth advisors and CPAs to see what strategies and tax savings are available to you.