When trying to minimize taxable income (especially around the holidays), many investors seek ways to be charitable. 2024 was a great year with markets nearing all-time highs, which leaves many investors with capital gains inside their portfolios. The purpose of this article is to introduce a dynamic charitable giving tool that can fulfill your philanthropic desires in a tax-efficient manner and is exploding in popularity. Despite the growing popularity among financial professionals, many investors are unaware of the numerous benefits donor-advised funds present. If you have highly appreciated investments and are charitably inclined, donor-advised funds can play a strategic role in your overall financial plan.

What is a Donor-Advised Fund?

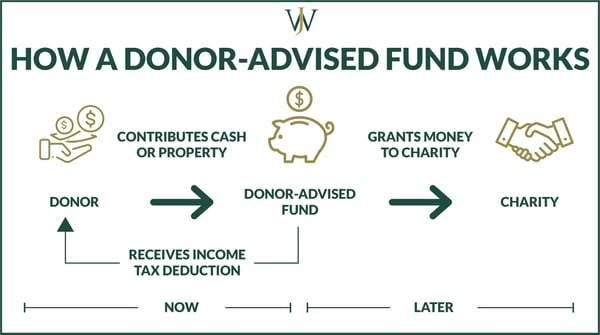

A donor-advised fund allows donors to establish and fund an account for philanthropic giving by making irrevocable, tax-deductible contributions to a third-party charitable sponsor. Donors retain advisory privileges and may recommend grants from those funds to other charitable organizations.

Over the last several years, donor-advised fund accounts have quadrupled in size. In 2015, approximately 272,781 donor-advised fund accounts existed, and by 2019, the number grew to 873,223. In 2022, there were over 1.2 million donor-advised fund accounts in the U.S. This explosive growth is primarily due to the many tax benefits and generous Americans' response to social and fiscal events that have unfolded over the last five years.

Donor-advised funds serve many different charitable organizations ranging across educational, religious, scientific, and artistic fields, as well as poverty relief or other pressing needs within communities. You can donate many different types of assets to donor-advised funds, but in this article, we will stick to illustrating the gifting of highly-appreciated securities.

How do Donor Advised Funds work?

-

- Select the fund you wish to contribute to

- Make ongoing irrevocable contributions to the fund and receive a tax deduction

- Invest for growth, determine your beneficiaries, and grant the money to charities of your choice

Let's illustrate through an example.

Suppose an investor named Levi purchased 1,000 shares of Microsoft stock in 2020 for $40/share. In 2025, that stock grows to be worth $300/share! Assuming a 23.8% Long-Term Capital Gain Rate, Levi would owe $43,500 in taxes upon sale.

Typically, Levi gives his church $20,000 in cash annually. However, instead of gifting money to his church, Levi could gift shares of his Microsoft stock through a donor-advised fund as a tax-savings strategy.

Let's say that instead of gifting $20,000 of cash, Levi gifts 60 shares of MSFT, which equates to $20,000 in his donor-advised fund. From his donor-advised fund, he could either invest for future growth to give to his church or distribute the funds immediately.

By gifting appreciated stock through the donor-advised fund, Levi avoids paying capital gains tax on the shares he gifts, saving him an additional $2.6k in taxes!

Alternatives to Donor Advised Funds: Charitable Remainder Trusts (CRTs) and Foundations

Many DIY investors want to give to charitable causes but don't know the most effective ways to do so. Besides giving directly in cash, the three most common methods are donor-advised funds, Charitable Remainder Trusts (CRTs), or Foundations.

What is a Charitable Remainder Trust, and What are the Benefits?

A charitable remainder trust is an irrevocable trust that allows a trustor to make contributions, be eligible for partial tax deductions, and make donations from remaining assets to the charity of their choice. Charitable remainder trusts are tax-exempt and can reduce taxable income for the trustor. This vehicle is beneficial for some financial planning situations as it disperses income to beneficiaries of the trust for designated periods before donating remaining trust assets to philanthropic organizations.

What is a Foundation, and What are the Benefits?

A foundation is set up as a tax-exempt legal entity by donors, typically families, who want to establish long-lasting charitable legacies. Typically, a donor makes a substantial initial contribution to the foundation, and the foundation's board of trustees or directors manages the funds and programs within it. Funds can be distributed to other charitable organizations or individuals designated by the foundation's directives, including family members. There are specific rules and tax considerations for how a group must run a foundation, which is beyond this article's scope. A key component is that the foundation must fulfill the 501(c)3 requirements set by the IRS to remain tax-exempt.

How to Choose the Right Charitable Giving Strategy for You

We recently met with a client whom we'll call April. She was concerned with the proposed tax law changes and what they meant for her situation. April wanted to discuss the best way to reduce the value of her estate through charitable giving. And she came prepared. During our meeting, she asked about setting up Charitable Remainder Trusts (CRTs) or a Foundation as a means to accomplish this goal.

Consideration #1: Low-Interest Rates & Charitable Remainder Trusts

With April, we explained how CRTs work and how they've become less appealing in today's low-rate environment. The present value of the income stream left to the non-charity beneficiary offsets the upfront tax deduction April would receive. Since rates are low, the present value of the income stream is high, making the upfront charitable deduction low for April. Additionally, April did not want to set up an "Income Beneficiary," so, given the numerous complexities of CRTs, we ruled out CRTs as a means to accomplish April's goal of tax-efficient giving.

Consideration #2: Foundations vs. Donor-Advised Funds

April came to us wanting to set up a foundation but with a minimal understanding of their trade-offs. Our team reminded her that while she can fund a foundation upfront for an immediate tax deduction, they are significantly more expensive to operate on an ongoing basis. Additionally, foundations may be subject to taxes on investment income, have required distributions, and require annual tax filings. Lastly, when compared to a donor-advised fund, foundations can have lower limitations on tax deductibility.

After explaining the trade-offs of each vehicle and learning more about her overall charitable goals, we determined the best way to accomplish April's charitable goals was to open a donor-advised fund.

Benefits of Donor Advised Funds

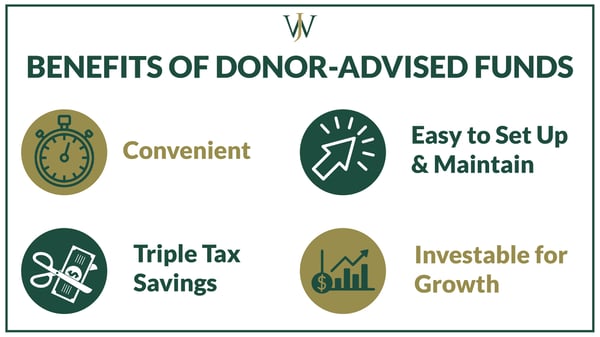

Donor-advised funds have many benefits that make them excellent additions to your overall financial plan for philanthropic endeavors. The benefits we discuss with clients most frequently are that donor-advised funds offer triple-tax savings, are simple to set up, convenient, and investable to give more to your preferred charities in the future.

Triple-Tax Savings

Among the benefits a donor-advised fund offers, the triple tax-savings opportunity is significant for today's investors.

- The year you make a gift to your donor-advised fund, you receive a charitable deduction.

- If you give appreciated stock, both you and the charity avoid paying capital gains tax. Therefore, you receive a double tax advantage, and your gift goes further since the charity doesn't pay taxes on the gift — This becomes an excellent rebalancing tool as well! Gifting appreciated stock inside a taxable account is a tax-efficient way to rebalance the account without triggering capital gains.

- Any time you make a gift from your estate, you effectively lower the estate's value, thus avoiding paying estate taxes on the estate's full value (assuming your total estate value exceeds the exemption amount)!

Let's consider another example: Levi has an estate worth $15m ( which exceeds the estate tax exemption amount by approximately $3 Million with current laws). To lower his overall estate size, he gifts all of his Microsoft stock to his donor-advised fund to avoid capital gains and future estate taxes, which gives him a tax savings of over $320,000!

Simple to Implement

Donor-advised fund accounts are simple to open. Most custodians (Fidelity, Vanguard, Schwab, etc.) have donor-advised fund accounts you can open and start gifting to charities right away. Opening a donor-advised fund to satisfy your charitable needs instead of creating a charitable remainder trust or a foundation can save you significant amounts of time and a considerable amount of money!

Convenient

If you choose to have one donor-advised fund, you can quarterback all of your charitable giving by consolidating everything in one place. Integrating your savings and philanthropic efforts like this can be a massive time-saver during tax season since all your documents are in one place. In addition, once you make a gift to your donor-advised fund, you can distribute the gift to your charity of choice at your leisure.

Investable

Piggybacking off of the example above, let's assume Levi gifted $330,000 of MSFT stock to his donor-advised fund. However, instead of immediately distributing 100% of the stock to a charity, he decides to spread distributions across the following 5-10 years.

An immense benefit of donor-advised funds is the ability for folks to invest the funds inside the account to grow their gift! In this example, Levi decides to invest his funds in a balanced portfolio (50% stock, 50% fixed income). As a result, his $330,000 investment can grow tax-deferred within his donor-advised fund to become an even larger donation to his preferred charities!

How to Use Donor-Advised Funds as a Tax Savings Strategy

We alluded earlier to Levi gifting a large amount of appreciated stock to charity to lower the value of his estate and avoid estate taxes. Strategic giving through donor-advised funds is also a viable strategy in very high-income years.

Let's say Levi is nearing retirement and expects a $250,000 deferred compensation payout before year-end on top of his regular salary and bonus. In this example, Levi could front-load up to 30% of his adjusted gross income into his donor-advised fund to receive a significant charitable deduction in the same calendar year. This front-loading strategy saves Levi approximately $55k in taxes in the current year by minimizing his adjusted gross income and can be done annually!

Another more common scenario exists when itemized deductions are below the standard deduction threshold. For example, suppose Levi wants to receive a more significant deduction for his charitable efforts. In that case, he can front-load his contributions to the donor-advised funds by gifting five times his annual gift amount and then distributing the gift over the next five years. In Levi's scenario, utilizing this strategy could result in a tax savings of approximately $10k!

Donor-advised funds can play a strategic role in your overall financial plan if you're looking for a tax-efficient way to minimize income and maximize what you gift to organizations you care about. Individuals can avoid capital gains and estate taxes or pass their assets to the next generation to continue the family's philanthropic endeavors by choosing to make contributions to donor-advised funds through appreciated securities. Our integrated team of portfolio managers, financial advisors, and CPAs helps our clients leverage strategies like donor-advised funds to accomplish their goals, but charitable giving is just one of the many goals our advisors can help clients accomplish on their road to financial independence. If you'd like to learn how we can help you position your financial plan to achieve your philanthropic goals, you can learn more about our process here.