The IRS has recently released the 2026 retirement plan contribution limits. For super-savers at Chevron, this is great news. Chevron employees can now contribute $24,500-$35,750, depending on their age, of pre-tax or Roth savings to the Chevron Employee Savings Investment Plan. That means that Chevron professionals can get up to $88,250-$101,600 of retirement savings into tax-efficient vessels in 2026, depending on their age. Let's look at the breakdown below.

| Source | Under 50 | Age 50-55 | 55-59, 64+ | 60-63 |

|

Fully maxing out all 401(k) sources

|

$72,000

|

$80,000

|

$80,000

|

$83,250

|

| Backdoor Roth |

$7,500

|

$8,600

|

$8,600

|

$8,600

|

|

HSA (family, +1 catch up where applicable)

|

$8,750

|

$8,750

|

$9,750

|

$9,750

|

| Total Retirement Savings | $88,250 |

$97,350

|

$98,350

|

$101,600

|

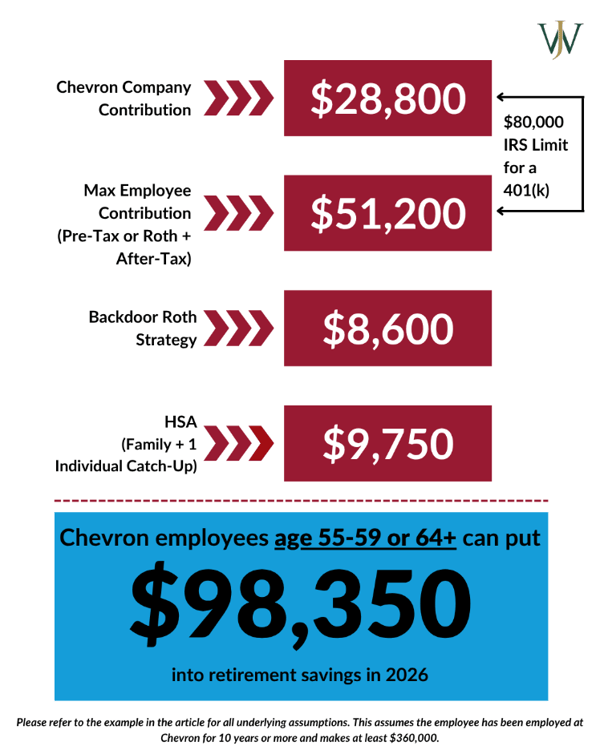

How Much Is Chevron's 401(k) Match?

Chevron offers up to an 8% match to employee 401(k) accounts. Since the annual compensation limit for 2026 is now $360,000, Chevron will cap contributions to the ESIP at $28,800. In 2026, once you begin making more than $360,000, Chevron will make its contributions to the Employee Savings Restoration Plan (ESIP RP) instead of the Employee Savings Investment Plan. If 2026 is the first year you expect to make over $360,000, check that you have an allocation and investment strategy set up for your ESIP RP.

How Chevron Employees Can Max Out the Chevron 401(k) if Under Age 50

If you’re under age 50, the total IRS limit for 401(k) contributions in 2026 from employee or employer contributions is $72,000. Here's how it breaks out:

- In Pre-tax or Roth: Employees under age 50 can contribute up to $24,500 across the two sources.

- In Non-Roth After-Tax Contributions: The maximum Chevron allows for after-tax contributions is $18,700 in 2026.

- Chevron's Employee Contribution: Chevron contributes up to 8% of an employee's compensation to their 401(k) each year. The maximum they can contribute in 2026 is $28,800 due to the IRS' income limits.

.png?width=602&height=753&name=Chevron%20-%20Max%20Savings_Chevron_Blog_2024_Q4_2025%20Contribution%20Limits_Under%20age%2050%20(4).png)

How Chevron Employees Can Max Out the Chevron 401(k) if You’re Over Age 50

If you’re age 50-59 or over age 63, the total IRS limit for 401(k) contributions in 2026 from employee or employer contributions is $80,000, broken out as follows:

- In Pre-tax or Roth: Employees in these age brackets can contribute up to $32,500 across the two sources, thanks to a $8,000 catch-up allowance.

Following the passage of SECURE Act 2.0, starting in 2026, catch-up contributions must be designated as Roth contributions for individuals making over $145,000 in annual income. This income threshold is indexed annually for inflation. - In Non-Roth After-Tax Contributions: The maximum Chevron allows for after-tax contributions is $18,700 in 2026.

- Chevron's Employee Contribution: The maximum amount Chevron will contribute to an employee's 401(k) in 2026 is $28,800 due to the IRS' income limits.

.png?width=602&height=753&name=Chevron%20-%20Max%20Savings_Chevron_Blog_2024_Q4_2025%20Contribution%20Limits_%20Age%2050-54%20(2).png)

In addition to the 401(k), there are valuable savings opportunities in vehicles such as the Backdoor Roth or HSA (which has additional catch-ups once you reach age 55). If you’re maxing out all of these sources alongside the backdoor Roth and full HSA contribution limit for families with an individual catch-up, you could save $98,350 in tax-efficient vehicles in 2026!

How Chevron Employees Can Max Out the Chevron 401(k) if Aged 60-63

Employees aged 60 to 63 after January 1, 2026, can contribute even more to workplace retirement plans thanks to legislation under Secure Act 2.0. Individuals in this age group have a higher catch-up contribution amount, indexed each year for inflation.

2026 Changes to 401(K) Contribution Limits for Those Ages 60-63 Under SECURE Act 2.0

Instead of the standard catch-up amount of $7,500 for individuals aged 50-59 or 63+, savers aged 60-63 can leverage a super catch-up amount of $11,250 in 2026 to boost their retirement savings. Here's how it breaks out across sources:

- In Pre-tax or Roth: Employees in these age brackets can contribute up to $35,750 across the two sources. Thanks to this new $11,250 super-catch-up amount, individuals can contribute $3,250 more than if they only had the standard over 50 catch-up of $8,000.

- In Non-Roth After-Tax Contributions: The maximum Chevron allows for after-tax contributions is $18,700 in 2026.

- Chevron's Employee Contribution: The maximum amount Chevron will contribute to an employee's 401(k) in 2026 is $28,800 due to the IRS' income limits.

This change provides a valuable opportunity for older employees to enhance their retirement savings as they approach retirement. Employees in this 4-year age bracket maxing out their Chevron ESIP, a family HSA with catch-ups, and backdoor Roths can save up to $101,600 in 2026!

.png?width=600&height=750&name=Chevron%20-%20Max%20Savings_Chevron_Blog_2024_Q4_2025%20Contribution%20Limits_Age%2060-63%20(6).png)

Are You Trying To Max Out Your Retirement Savings this Year?

Learn how to leverage your 401(k) savings with other financial strategies here >

Smart Savings Strategies After Maxing Out Your 401(k): Backdoor Roths, HSAs, and More

Roth accounts are one of the most effective ways to grow wealth for the future because your money grows tax-free. Contributions are made with after-tax dollars, so when you retire, you can withdraw both your contributions and earnings without owing taxes. For many Chevron professionals, this helps create flexibility in retirement by balancing taxable and tax-free income and keeping more of what they’ve worked hard to earn.

Backdoor Roth Contributions if You Can't Directly Contribute to Roth IRA

The IRA contribution limit for 2026 increased to $7,500 ($8,600 if over age 50). Though many high-income earners are prevented from directly contributing to a Roth IRA, many Chevron employees can take advantage of the backdoor Roth strategy to get more saved in Roths each year. This strategy is nuanced and can cause more harm than good if enacted poorly, so be sure to discuss it with a financial advisor if you want to incorporate it into your financial plan.

Using a Mega Backdoor Roth Strategy with After-Tax 401(K) Contributions

The maximum amount Chevron employees can put toward after-tax contributions to get the full Chevron match benefit has increased to $18,700. Some Chevron professionals accidentally overfund the after-tax source within the 401(k), which can impact the contributions they receive from Chevron.

If you are contributing after-tax dollars to the Chevron ESIP, consider rolling out the after-tax funds to a Roth IRA at the tail end of the third quarter to take advantage of the mega backdoor Roth strategy. For many Chevron employees that are contributing after-tax, the end of the third quarter is the best time to do what we call an "after-tax rollover" because Chevron will freeze all company and employee after-tax basic contributions to the ESIP for the 90 days that follow the distribution.

Maxing Out Chevron's Health Savings Account for Tax-Optimized Savings

A Health Savings Account (HSA) is often an under-utilized benefit that provides a unique triple tax advantage:

- Tax-Deductible Contributions: Contributions made to an HSA are tax-deductible, which means they lower your taxable income in the year you make the contribution. This can reduce your overall tax liability. This year, Chevron employees can contribute up to $8,750 (or up to $10,750 if both spouses are over age 55 and contributing to their respective HSA accounts) for a family. For individuals, the maximum HSA contribution is $4,400

- Tax-Free Growth: The funds in your HSA can be invested, and any earnings or capital gains from these investments are tax-free as long as they remain in the account. This allows your savings to grow over time without incurring taxes.

- Tax-Free Withdrawals for Qualified Medical Expenses: When you use the HSA funds for qualified medical expenses, the withdrawals are entirely tax-free.

When using an HSA as a retirement fund, Chevron employees can benefit from both tax deductions and tax-free growth, making HSAs a valuable tool for long-term savings and retirement planning.

| Source | Under 50 | Age 50-55 | 55-59, 64+ | 60-63 |

|

Fully maxing out all 401(k) sources

|

$72,000

|

$80,000

|

$80,000

|

$83,250

|

| Backdoor Roth |

$7,500

|

$8,600

|

$8,600

|

$8,600

|

|

HSA (family, +1 catch up where applicable)

|

$8,750

|

$8,750

|

$9,750

|

$9,750

|

| Total Retirement Savings | $88,250 |

$97,350

|

$98,350

|

$101,600

|

What If You Make Over the 401(k) Compensation Limit in 2026?

The annual compensation limit for 2026 has increased from $350,000 to $360,000. If you make over $360,000 in base and bonus compensation for 2026, remember to ensure that you max out your ESIP contributions before earning $360,000. After you earn $360,000 of income, you and Chevron can no longer contribute to the Employee Savings Investment Plan.

What Happens if You Make More than the 401(K) Income Limits?

Chevron offers up to an 8% contribution to employee 401(k) accounts. Since the annual compensation limit in 2026 is now $360,000, Chevron will cap out its contributions to the ESIP at $28,800. Once you exceed the annual income threshold, Chevron makes their contributions to the Employee Savings Restoration Plan (ESIP RP) instead of the Employee Savings Investment Plan.

If 2026 is the first year you expect to make over $360,000, check that you have an allocation and investment strategy set up for your ESIP RP.

When using an HSA as a retirement fund, Chevron employees can benefit from both tax deductions and tax-free growth, making HSAs a valuable tool for long-term savings and retirement planning.

Get a Tailored Savings Plan From an Advisor with Specialized Chevron Benefits Knowledge

At Willis Johnson & Associates, we work with our Chevron clients to ensure they get the full 8% company contribution, take advantage of backdoor Roth IRAs for long-term tax savings, and facilitate after-tax roll-outs from the Employee Savings Investment Fund to help optimize retirement. If you have any questions about the 2026 contribution and compensation limits, please contact your advisor or schedule a free consultation with one of our Chevron specialists.