Bonus season is finally here! From dream vacations to visions of paying off expenses, your hard-earned bonus holds exciting potential. For Shell super-savers seeking to make the most of their bonus, the clock starts ticking the moment it hits your account. This spring, unlock the full power of your bonus with strategies devised to help you reach your financial goals, invest for future growth, or simply make your bonus work smarter for you.

Shell Bonus Formula & Calculation Factors

To determine an individual’s bonus, Shell looks at three factors:

- The employee's job grade with a target bonus,

- individual performance, and

- the company's annual performance.

When evaluating company performance, Shell reviews financial targets and their performance in the industry to determine the company’s bonus factor. In the years where Shell performs well, the bonus payouts have been higher. For some employees, Shell awards spot bonuses for exceptional individual performance in managing or completing Company strategies.

In 2024, we expect to see a larger bonus payout than in recent years. Shell’s adjusted earnings for 2023 were $28.3 Billion with a 1.58 company factor. With this larger payout for Shell employees, there are strategies and opportunities to consider leveraging.

How is the Shell Bonus Taxed?

Bonus season is the perfect opportunity to do a tax tune-up and review your withholdings. Why? Because you want to avoid two possible surprises come April: a hefty tax bill, or a potential penalty. Remember, bonuses are treated differently than regular income. They're considered "supplemental income," and the IRS takes a flat 22% out of them for supplemental income up to $1 million.

As a high-income professional at Shell, withholding 22% might not be enough to cover your full tax bill. That's where working with a professional tax team comes in—They can assess your current withholdings and calculate any additional payments you may need after your bonus hits to avoid penalties. One way to think of it is as an investment in your peace of mind, avoiding last-minute scrambles and unnecessary fees.

How the Shell Bonus Impacts Pension Payouts

At Shell, you have two pensions that you may be eligible for depending on when you began employment: the 80 Point Pension and the APF Pension. For either pension, your average final compensation (AFC) plays a crucial role in the calculation of your benefit.

The higher your AFC, the higher your pension benefit at retirement. Specifically, Shell uses the highest three years of average final compensation within the last ten years to determine your pension payout. One thing many Shell professionals notice when evaluating their AFC over the last ten years is the impact COVID had on their annual compensation in 2020 and 2021. If you recall, due to the global shutdowns and the energy sector’s performance in those years, many Shell professionals received minimal bonuses or no bonus at all. However, if we fast forward to 2022 and 2023, we see a huge rebound in energy. As a result, many Shell professionals received promotions, salary increases, or higher bonuses than average.

If your retirement date from Shell is flexible, waiting until you receive your 2023 bonus payment in 2024 to retire could be precious so that your pension calculation includes this higher AFC number.

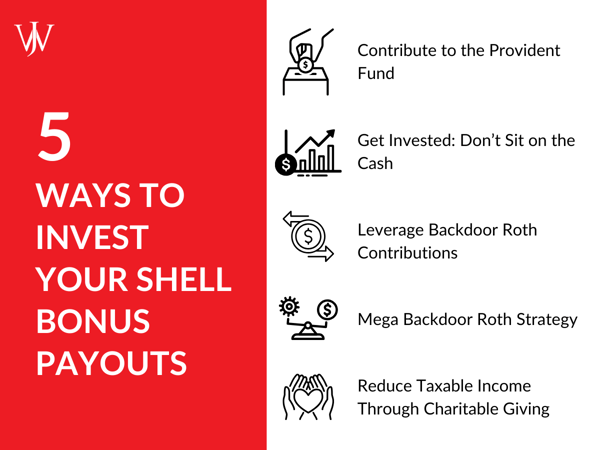

Investment Strategies for Your Shell Incentive Plan Payout

Many Shell professionals come to us with the same question: "With my annual performance bonus on the horizon, should I invest it or keep it in a savings account?" As with every financial decision, the answer truly depends on your circumstances and future goals. However, there are several popular strategies that Shell professionals often consider after receiving their payout each March. Let's delve into some of these options:

Contribute to the Provident Fund

Because the bonus payouts are in March, you should plan to check your Shell Provident Fund contributions before and after the bonus payout. In 2024, you can contribute up to $23,000 if you’re under 50 to either pre-tax or Roth sources in the 401(k). If you’re over 50, that number increases to $30,500 for this year. Beyond the pre-tax and Roth sources in the 401(K), it's important to check your year-to-date 401(k) contributions percentages to max out the after-tax source too. The maximum amount you can contribute to Shell’s after-tax source in 2024 is $11,500.

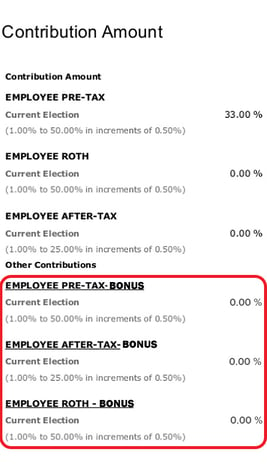

Making 401(k) Contributions Directly from Your Bonus

Let’s say you want to use your bonus to make 401(k) contributions this year in hopes of maxing out all sources in the Provident Fund. If so, you must set up those elections in Fidelity before the bonus gets distributed.

Even if you’re making contributions from your paycheck, the default election for bonus contributions to the 401(k) is 0%. If you know you will reach or exceed 2024's income limit of $345,000 this year, you can consider front-loading your contributions from your paycheck and bonus to ensure you max out the 401(k) before exceeding the threshold. For high-income Shell employees, this can make a HUGE difference in how much they can save each year. Once an employee crosses the threshold of the IRS’ 415 income limits, neither Shell nor the employee can contribute to the 401(k). So, if you receive a significant bonus but don’t make contributions to the 401(k) from it, you may be leaving a lot of money on the table for retirement.

Learn how to max out your Shell 401(k) this year here >>

Get Invested: Don’t Sit on the Cash

Inflation numbers are at 3.1% as of January 2024, which means that due to ongoing inflation, any cash is effectively losing purchasing power by 3.1%. To have a sound financial plan, holding some cash-on-hand is necessary for emergencies, but carrying too much cash can be detrimental to a plan. To break even on your cash’s purchasing power, you need to earn 3.1% on investments. With the approaching bonus payout in March 2024, it would be well advised to review your cash holdings and determine if you should reinvest any funds, allowing growth to surpass inflation.

Leverage Backdoor Roth Contributions

There are several options available for where you can invest excess cash. For example, if you've maxed out your 401(k), you can contribute to an after-tax account or make a backdoor Roth contribution. If you are a high-income earner, you probably already know that you can’t contribute directly to a Roth IRA.

The backdoor Roth contribution strategy is a way to get around the income limitation and still save money in a Roth IRA. With a backdoor Roth contribution, you can roll your excess cash over into a Roth IRA, where that money can grow tax-free in the long term, even if you’ve surpassed the income limits that prevent you from directly contributing to a Roth. With backdoor Roth contributions, you can make a nondeductible IRA contribution of $7,000 if under 50 or $8,000 if over 50. After you have contributed to the IRA, you convert the IRA to a Roth IRA and enjoy tax-free growth for life.

Mega Backdoor Roth Strategy

If you are contributing after-tax dollars to the Shell Provident Fund, you can also roll out the after-tax funds annually to a Roth IRA to take advantage of a strategy known as the mega backdoor Roth strategy.

When you make after-tax contributions in your Shell Provident Fund 401(K), you have two options for what you can do with those funds: leave them in the 401(K) or roll them out via a Roth conversion to a Roth IRA. If you leave the funds in the 401(K), at withdrawal, your contributions will be tax-free, and any growth you accumulate will be taxed at ordinary income rates. That’s not too tax-efficient. If instead, you annually roll the after-tax funds over to a Roth IRA, the growth and contributions grow tax-free for life!

Learn More About the Mega Backdoor Roth Strategy Here >>

Reduce Taxable Income Through Charitable Giving

While a noteworthy bonus may bring delight, it can also result in a higher-than-average income year and a significantly higher tax bill. You can strategically pull a few levers while you're working to minimize your tax bill – max out pre-tax retirement savings accounts, deduct property taxes up to $10,000, deduct mortgage interest on up to $1m of debt, and deduct charitable donations.

Like many of our clients, you may be charitably inclined, and making a significant charitable gift in a high-income year can be incredibly beneficial to lowering your tax bill. Some options include - direct contributions to a charity or a Donor-Advised Fund (DAF) to bundle your charitable gifts into more significant lump-sum donations.

Advisor tip - To maximize the tax efficiency of your contribution, you can donate appreciated stock instead of cash.

In addition, gifting appreciated stock directly to a charity, or a DAF offers you an itemized deduction on your tax return and avoids the capital gains taxes on the stock. With your bonus payout, you can replace the stock value with cash and either reinvest in the same stock or diversify elsewhere.

Make Your Investments Go Further by Working with a Financial Advisor

The annual bonus payout is a well-deserved reward for your hard work at Shell. But amidst the excitement comes an important question: how can you leverage this benefit to propel yourself and your family toward your financial goals?

At Willis Johnson and Associates, we understand the unique needs of Shell employees. We partner with you to make the most of your bonus each year, keeping your goals, tax implications, savings priorities, and other benefits top-of-mind. As a planning-led firm, our advisors are equipped to:

- Leverage your benefits: Maximize the value of your Shell benefits and compensation package so you don't leave any money on the table.

- Craft a personalized strategy: Once we know what’s available to you, we delve into your financial aspirations and current tax situation so we can tailor solutions that fit your individual needs.

- Navigate the tax landscape: Ensure you keep more of what's yours by leveraging tax strategies to lower your tax burden over time.

- Prioritize savings: Identify the most impactful savings vehicles to achieve your short- and long-term goals.

Investing in your future starts today. Our experienced advisors can help you establish a robust financial plan for any stage of life. Our goal is to make the complex simple so you can achieve financial freedom, whether it's planning for retirement, caring for loved ones, or donating to the charities you care about most.

Get started by scheduling a complimentary consultation with the advisors at WJA. We’ll discuss your financial goals and Shell benefits, and together, we'll craft a personalized plan to help you achieve financial independence and fuel your future success.