When you think about your BP retirement benefits, your BP 401(k), the Employee Savings Plan (ESP), probably comes to mind first. Like many company's 401(k) plans, you get to make contributions, determine where to invest those contributions, and BP matches a designated percentage of contributions for you as well.

However, the BP Retirement Accumulation Plan ("RAP") pension is a significant benefit for BP employees that can have a substantial impact on your overall financial picture. The RAP is interest-credited and entirely funded by BP. As a result, you don't have to make any contribution or investment decisions to receive the benefit when you retire. But, you should not just ignore your pension until retirement. It's essential to understand how the pension calculation works and what impact your decisions will have. Let's dive in.

What is a Pension?

A pension is a retirement savings tool where an employer regularly contributes a set amount of funds to a designated pool of money that will make payments to an employee upon retirement.

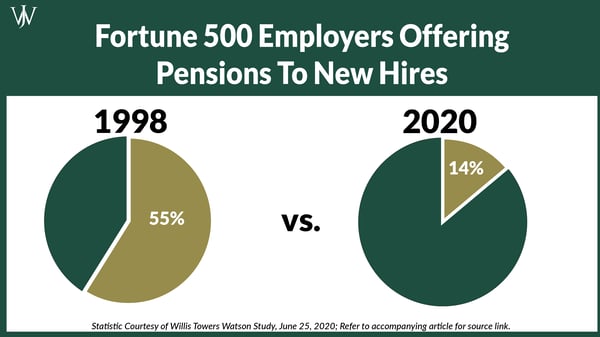

Pensions are a unique offering these days. According to a recent study by Willis Towers Watson, only 14% of the largest companies in the U.S. offer pensions, also referred to as "defined benefit plans." The study notes that this is a significant decrease from the 59% of large companies which offered pensions in 1998.

The 2021 Milliman Pension Study showed that many employers did not fund pensions to cover 100% of the plan participants' benefits. However, the actuarial assessment of BP's pension fund determined that as of January 1, 2021, the Retirement Accumulation Plan had a funding ratio of 133%, meaning that BP can fund its pension plan to cover potential benefits for all participants at this time.

How Does the BP Pension (RAP) Work?

BP Pension is Funded Through Pay Credits

Under the RAP pension, BP employees have individual cash balance accounts to which BP contributes based on

(a) years of service or age and

(b) base and bonus compensation (excluding stock and spot compensation).

BP credits the employee's pension account using two percentages. The first is a percentage applied to the employee's earnings up to the designated "Eligible Earnings Threshold," which the Social Security Wage Base determines (more on that below). The second is a credit percentage applied to the employee's earnings that exceed the "Eligible Earnings Threshold" but below the pension contribution limit.

|

Pay Credit Formula

(whichever provides the greater percentage): |

Credits as a percentage of

Your Eligible Earnings

(up to $35,700 in 2021) |

Credits as a percentage of

Your Eligible Earnings

(above $35,700 in 2021) |

||

|

Years of Vesting Service

|

Age

|

|||

|

Under 10

|

and

|

Under 40

|

4%

|

7%

|

|

10 but less than 20

|

or

|

40 but less than 50

|

5%

|

9%

|

|

20 or more

|

or

|

50 or more

|

6%

|

11%

|

Using the chart above, we can look at two hypothetical BP employee scenarios to illustrate how BP contributes to the RAP Pension.

Example 1: 35 years old with base and bonus equal to $100,000

Because the Participant is under 40, BP contributes:

4% of $35,700 = $1,428

7% of the amount above $35,700 up to $100,000 = $4,501

Total: $5,929 for 2021

Example 2: 45 years old with 20 years of service with base and bonus equal to $200,000

Because the participant is over 40 with 20 years of service, BP contributes:

6% of $35,700 = $2,142

11% of the amount above $35,700 up to the 2021 annual social security threshold ($142,800) = $11,781

Total: 13,923 for 2021.

Social Security Thresholds

The eligible earnings thresholds change annually based on the social security wage base. BP's eligible earnings threshold is one-fourth of the social security wage base for the year. For example, since the social security wage base for 2021 is $142,800, the eligible earnings threshold used to calculate the BP RAP Pension contribution for 2021 is $35,700 as applied above.

Pension Limits & BP's Excess Compensation Plan (ECP)

The IRS limits how much of an employee's compensation BP can use to formulate its contribution to the RAP pension. In 2021, that limit is $290,000. BP directs the contributions beyond the compensation limit (including base and bonus) to the Excess Compensation Plan (ECP). The ECP is a non-qualified plan which means that it does not have the legal protections that the RAP pension or ESP 401(k) have. The ECP also has more rigid distribution requirements.

Learn more about the ECP and its distribution rules here >>

Let's look at another hypothetical BP employee scenario to illustrate how BP contributes to the Excess Compensation Plan.

Jake is a 45-year-old employee with 20 years of service whose base and a bonus equal $300,000.

Because the participant is over 40 , has 20 years of service, and makes over $290,000, BP contributes:

6% of $35,700 = $2,142

11% of the amount above $35,700 up to $290,000 = $27,983

Total: $30,115 for 2021 to the RAP Pension , and:

11% of amount above $290,000 = $1,100

Total: $1,100 for 2021 to the Excess Compensation Plan (ECP)

BP Funds Pension Through Interest Crediting

In addition to the contribution BP makes to the pension, BP also credits each participant's account with an annualized interest amount.

|

Participants hired prior to 1/1/2016 |

Participants hired on or after 1/1/2016 |

Participants rehired on or after 1/1/2016 |

|

Monthly crediting of the greater of 30-year treasury rate* or a minimum 5% annualized interest |

Monthly crediting of the greater of 30-year treasury rate* or a minimum 2% annualized interest |

Monthly crediting of the greater of 30-year treasury rate* or a minimum 5% annualized interest on amounts accrued prior to 1/1/2016, and a minimum 2% on amounts accrued after 1/1/2016 |

*Monthly 30-year treasury from September of the prior year. The effective rate for 2021 is the September 2020 rate of 1.42%.

How Interest Rates Impact Pensions

We are amidst an unusually low interest rate environment. As shown in the chart above, the minimum applicable crediting rates of 5% and 2% are well above 2021's applicable treasury rate of 1.42%. The applicable rate for 2022 is 2.10%, just above the minimum crediting rate for those hired post-2015. These current low interest rates are a consideration you should incorporate in your more extensive planning, which we will address next.

BP Pension Election Options

Under the BP RAP pension, you have two main options for how your pension will pay out to you: an annuity or a lump sum.

- Annuity: an income stream paid monthly based on the date you decide to start the income stream and your expected life expectancy.

- Lump Sum: A lump sum derived one of two ways based on your years of service with BP; You can roll these into an IRA after leaving the company

|

How to Choose for Your BP RAP Pension: Lump Sum or Annuity |

||

|

Participants hired before 1/1/2014 |

Participants hired on or after 1/1/2014 |

Participants rehired on or after 1/1/2014, but before 1/1/2016 who have maintained their participant benefit in the plan from before 1/1/2014 |

|

Choose the greater of: a) the cash balance of your pension account |

The cash balance of your pension account |

Choose the greater of: a) the cash balance of your pension account |

The chart above illustrates a simplified way of determining how to choose between the lump sum or annuity options for your pension payout. For participants in the BP pension who became BP employees through corporate mergers with Amoco, ARCO, and Castrol, there are additional calculations for the RAP Pension benefit where the chart above may not be sufficient. One of the key determinations with your pension is which payout option – annuity or lump sum – works best for your situation.

We Discuss the Pros & Cons of Each Option in Our Timing BP Retirement Webinar. Watch it Now >>

Investment and Savings Strategies for BP Pension Participants

Your BP RAP pension accrues during your employment at BP through BP's pay credits and interest crediting without any participation from you. However, that does not mean your pension exists in a silo of its own — you still have other decisions requiring your attention.

How to Invest if You Have a Pension

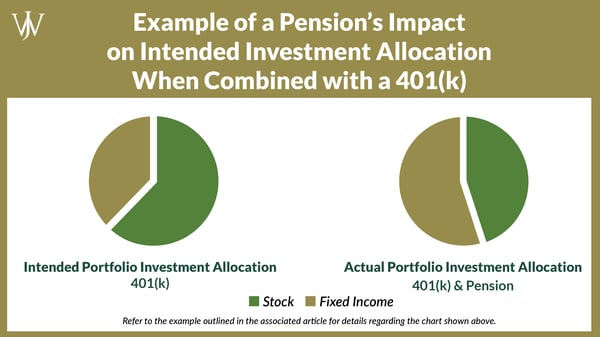

While the crediting amount might be slightly variable, the value of your pension account is stable and growing over time. There is no market risk in the account. As such, your RAP Pension account acts as a fixed holding within your broader financial picture. If you look at your pension fund alongside your other accounts or, at least, your other retirement accounts, it may change how you wish to consider the investment allocation of your other accounts.

For example, let's assume you have $900,000 in your BP 401(k). You want to take a moderate amount of risk in your investments, so you direct your 401(k) assets to a 60% stock and 40% fixed income allocation. Let's assume your projected lump sum benefit within your RAP Pension is $400,000. If you view the pension as part of your retirement portfolio, you have $1.3 million in retirement savings. As a result, you also have a fairly conservative portfolio — with over 55% of your portfolio in fixed income, which isn't the moderate risk you may have intended.

Additionally, with the current, historically low interest rates, you may be greatly diminishing your opportunity to accrue by being less exposed to stock. At Willis Johnson & Associates, our advisors look at our client's broader picture when discussing allocation to ensure that their asset allocations align with their risk tolerance and financial goals.

Where to Save for Retirement If You Have a Pension

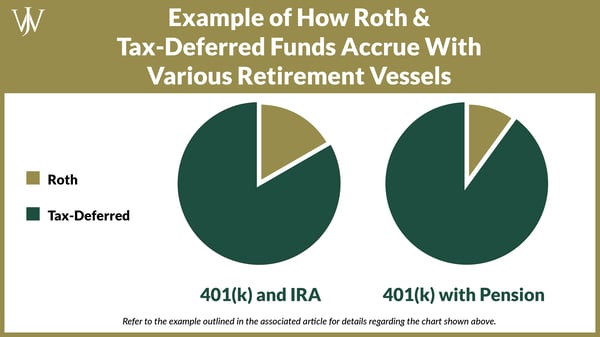

The BP RAP pension is pre-tax, just like other traditional retirement plans like a traditional IRA or 401(k). After you leave BP, your funds can remain in the pension plan for future distribution (the pension must be distributed by age 72), or you can roll your pension funds over to another pre-tax plan like your 401(k) or IRA, where it remains tax-deferred.

Once you take a distribution from the pension, that distribution is taxed at ordinary income rates, just like distributions from a 401(k) or an IRA. Because your pension account functions similarly in distribution to a traditional 401(k) or traditional IRA, you should incorporate it with your tax pool planning.

Tax Pool Planning

When determining how to allocate your investments in accounts, you should also decide how to allocate across tax pools – taxable (after-tax) accounts, tax-deferred (pre-tax) accounts, and Roth accounts. Typically, a person's highest-income years will be when they earn a salary, not when they retire. Based on this circumstance, we usually emphasize pre-tax savings for retirement during working years.

However, as you near retirement, you may find that you have more pre-tax savings than is efficient. Over many years, as you contribute to pre-tax savings and they accrue with investment, your pre-tax pool can add up quickly when combined with the pension — This can be particularly true for people later in their careers.

Using the same example above, let's say 15% of your $900,000 401(k) is in Roth. Your $400,000 RAP pension lump sum is still all pre-tax. If you incorporate the pension when looking at your retirement funds, your Roth savings are closer to 10% than the originally anticipated 15%.

Incorporating the pension is vital to overall financial planning. In several instances, Willis Johnson & Associates' advisors have developed projections for BP professionals showing that required pension distributions will far exceed a client's expenses in retirement. Without proper planning, these professionals will pay ordinary income tax on distributions they do not need! Therefore, we start looking for opportunities to build after-tax or Roth savings either before or immediately post-retirement.

Incorporating Your BP RAP Pension Into Your Financial Plan

Your RAP pension, with BP's contribution and crediting, has the potential to accumulate into a significant benefit for you. However, viewing your pension as simply a surplus to your retirement savings in the BP ESP 401(k) plan will limit your potential for strategic planning.

The best financial planning is about framing and evaluating your entire financial picture, weighing your options, implementing the best strategy, monitoring results, and staying nimble to pivot when necessary. Expertise in both financial planning and BP benefits can help you in all of these strategies. Willis Johnson & Associates (WJA) advisors know the complexities of BP's retirement benefits and how they can effectively work together. We help BP employees and retirees clarify their goals and resources, evaluate and educate them on the best opportunities for meeting those goals, and implement and maintain the strategies to achieve their objectives. As fiduciary advisors, we always work in your best interest to help you reach your financial goals. Thinking about your BP RAP pension is about more than making the necessary elections as you prepare to leave BP. Your pension is a unique benefit and a critical consideration for the decisions you'll make in other parts of your financial life today. You can learn more about how we help BP professionals here or connect with our team for a complimentary benefits and financial planning review.