All money spends the same.

That adage is technically true. However, not all money is saved in the same way, and making strategic savings choices can have a tremendous impact on your overall saving efficiency and success.

For highly compensated Shell employees, deferred compensation is one benefit the company offers to give them an additional saving and tax management option.

Specific Internal Revenue Service (IRS) guidelines impact the amounts that may be contributed to a 401(k) or pension (These amounts are subject to change annually.) Employees who qualify can have up to 10 percent of their compensation in excess of IRS limits contributed to a deferred compensation plan.

How Do Shell’s Deferred Compensation Plans Work?

Many companies, including Shell, will contribute a percentage of high-earning employees’ excess compensation into a deferred compensation plan.

Depending on the employee’s compensation margin (the amount over the IRS-defined thresholds) and the number of years earning at a high level, a substantial fund may begin to build up in the employee’s deferred compensation account.

And, on top of these ongoing annual contributions, fund balances will also benefit from earning compounded interest or growing with the market during the time they’ve invested.

How Does Shell’s Deferred Compensation Plan Pay Out?

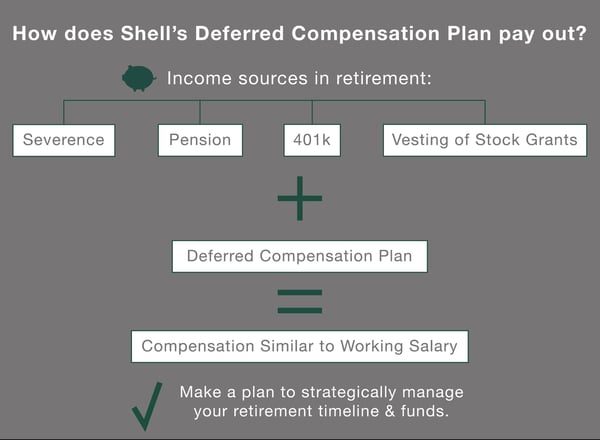

A deferred compensation plan can provide a very beneficial source of additional income in retirement. It’s important to consider retirement income holistically, including methods of disbursement, as funds will be received from multiple sources.

In retirement, you’ll likely begin accessing your income from sources including severance, pensions, 401(k), and the vesting of stock grants. When you add a deferred compensation plan that’s been growing for many years, you may find your retirement compensation is at a similar level to your typical working salary and you need a plan to strategically manage your retirement timeline and funds.

What’s the Difference Between Shell’s New Money and Old Money Deferred Compensation Plans?

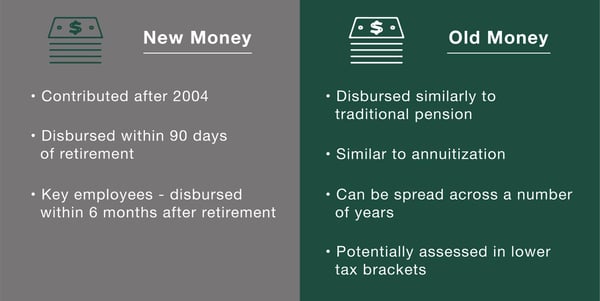

For some long-term Shell employees, their deferred compensation may be conveniently divided into two disbursement options: Old Money and New Money.

New money is money Shell has contributed to your deferred compensation plan after 2004. This money must be disbursed within 90 days of retirement for most employees. For those deemed key employees, the distribution window expands to six months after separation from the company.

Old money, on the other hand, is eligible to be disbursed in a manner similar to a traditional pension. This process, similar to annuitization, allows the old money to be spread across a number of years and therefore potentially assessed in lower tax brackets.

Who Qualifies for Shell’s New Money and Old Money Deferred Compensation Plans?

The only employees who qualify for both Shell’s Old Money and New Money plans are those who were making qualifying levels of income prior to 2005. Many of the employees who were earning at high levels during that time period have already retired.

We occasionally see situations where employees may have experienced a high-earning year or two during the Old Money time period (traders are a good example) and may be unaware that they received deferred compensation or their funds have been steadily growing over the intervening 15 to 20 years.

How Do I Know Whether I Have Old Money or New Money in My Deferred Compensation Plan?

When you log into your Net Benefits account, you can review your Deferred Comp BRP. It should list the funds as either Old Money or New Money.

As a general rule, only those employees who were highly compensated prior to 2005 will have Old Money in their accounts, and you would likely be aware of your earnings and of your deferred compensation benefits.

However, it’s possible you might have been grouped in this category for a year or two if you had an exceptional performance factor one year, or if Shell as a whole had an excellent year.

What Should I Do to Maximize the Value of My Deferred Compensation Plan?

Our advisors work with Shell executives to review their retirement options and opportunities, including deferred compensation. If you weren’t aware you had deferred compensation available to you, you might be pleasantly surprised at the funds that have accumulated.

Even better, working with one of our associates can help you to get the most benefit from these retirement funds. By making informed tax planning decisions, we can help you ensure you minimize the impact of taxes on your deferred compensation and other retirement funds.

If you want to have an additional conversation about deferred compensation, tax planning strategies, or your plans for retirement, our team of advisors is available to help. Learn more about the many ways we support Shell executives and professionals and about how Willis Johnson & Associates serves our clients.