If you’re a career Chevron employee, you’ve probably heard the term NUA mentioned when your colleagues discuss their ESIP 401(k)s or retirement. It can be helpful to have a thorough understanding about what NUA means and how it can affect your retirement, so you can plan accordingly.

What Does NUA Stand For?

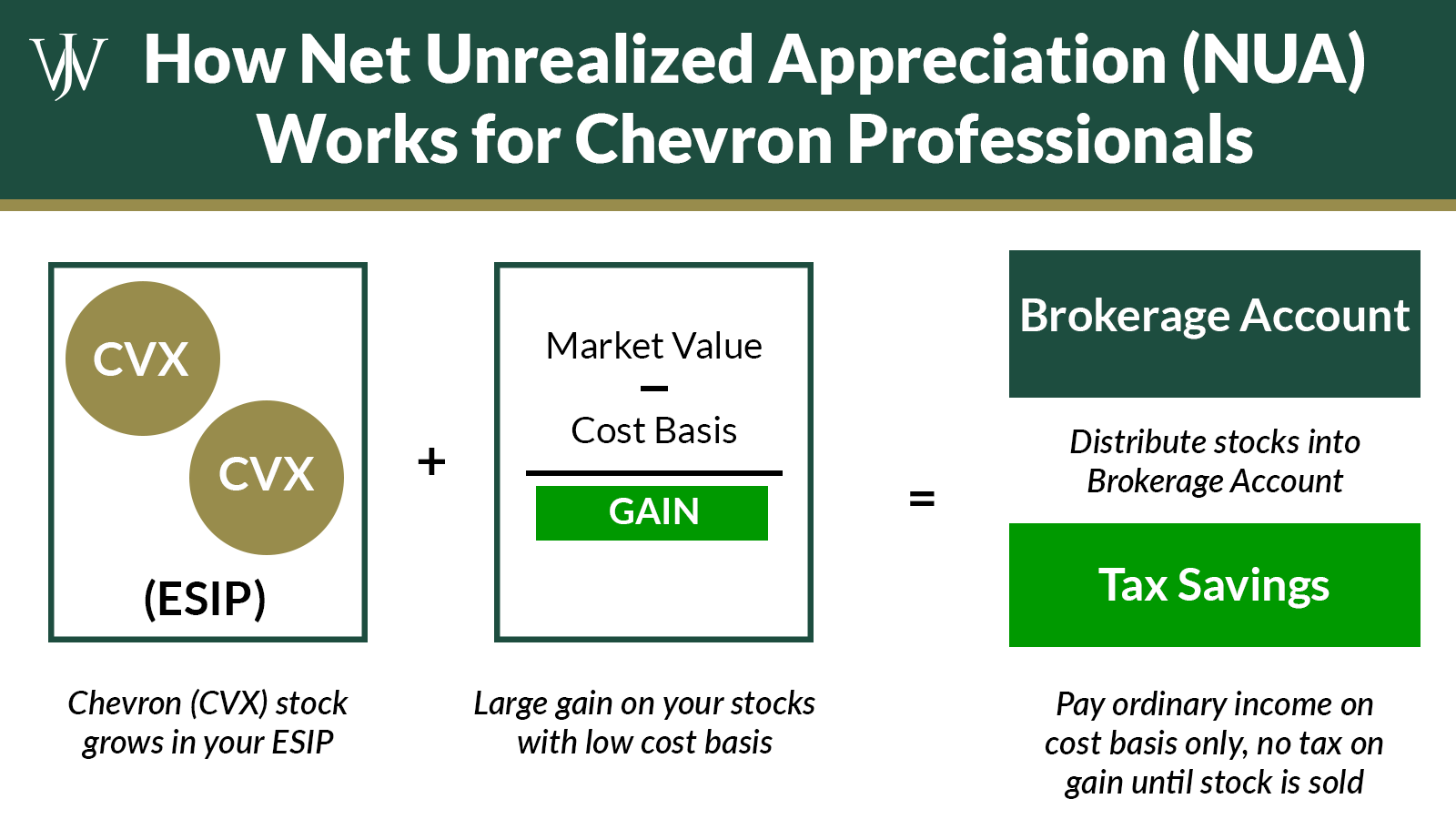

NUA stands for Net Unrealized Appreciation. It’s the difference between the cost basis of shares (what you or your employer paid for the stock) and their current market value held in a tax-deferred account.

How Do I Know if I Have NUA or Whether I Can Use it to My Advantage?

If you have Chevron (CVX) stock in your ESIP, you may have an NUA distribution opportunity. To evaluate whether you can benefit from NUA, you should take a look at the stock’s cost basis (original cost at purchase) and compare that sum with its current market value.

If you see your stocks have made a large gain, you may have a valuable opportunity to make an NUA distribution and minimize the taxes you pay on this stock.

If you have NUA, you can distribute the stock from your ESIP to a brokerage account, instead of rolling it over to an IRA.

You’ll pay ordinary income taxes on the cost basis at the time of the distribution, but you won’t pay any taxes on the gain unless you actually sell the stock. When you sell the stock in the future, you will pay long-term capital gains taxes on the gain.

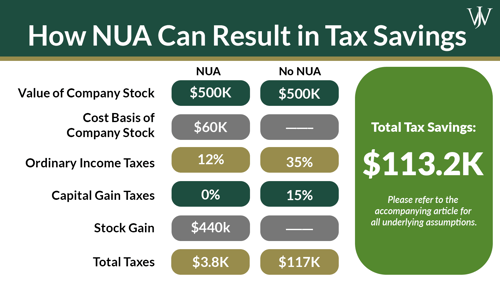

Taking this approach can yield huge tax savings if your cost basis is comparatively low. This example shows how you can benefit from making these strategic choices:

- Jane, a married Chevron retiree, has $500,000 of CVX in her ESIP account.

- Jane has been monitoring her annual income in retirement to make efficient tax decisions. For example, she took her Chevron pension in a lump sum and she’s distributed her income in order to stay in the lowest tax bracket (12% for ordinary income).

- The cost basis for the CVX shares in her ESIP account is $60,000.

- The gain on the stock is $440,000 ($500,000 - $60,000).

In one of her very low-income years after retirement, Jane decides to distribute the entire value of her CVX stock from the ESIP into her individual brokerage account.

What are the Tax Implications of Jane’s Decision?

- Instead of paying ordinary income taxes on the entire $500,000, because of NUA, Jane will only pay ordinary income taxes on the cost basis of $60,000.

- She will pay $3,800 in taxes on a $500,000 distribution from her 401(k).

- She can then sell the stock at a long-term capital gains rate of 0% over the next seven years before she starts Social Security or required minimum distributions (RMD).

Alternatively, if Jane rolled the entire balance of her ESIP to an IRA without taking advantage of the NUA opportunity, she would have to pay ordinary income taxes on the entire $500,000 of CVX stock if she distributed it from the IRA. If she took the entire $500,000 out in one year, she would be in the 35% marginal bracket and her tax bill would be about $117,000.

That’s a tremendous jump in taxes and a hard hit to Jane’s retirement savings. Even if she chose to spread out the $500,000 into five years of $100,000 distributions, she still would pay a much higher tax rate than in the scenario where she takes advantage of NUA.

Many career Chevron employees and retirees, like Jane, have large gains on the CVX stock in the ESIP because Chevron made employer contributions to the ESOP plan within the ESIP before 2013.

Those contributions have now been discontinued, but if you were fortunate enough to enroll in this program before 2013, you likely benefited greatly and have also seen significant gains on the CVX ESOP stock you accumulated.

Are There Any Challenges I Should Know About Related to Using NUA?

NUA can be a valuable advantage when you’re preparing for retirement. However, you must ensure you meet and follow the qualifying guidelines for NUA; otherwise, it can have a negative impact on your tax responsibilities and your ability to do this type of disbursement. Requirements for NUA include the following:

- Employer stock must be distributed in-kind as shares. It cannot be liquidated before the distribution.

- Your entire ESIP balance must be made as a lump-sum distribution (distributed in the same calendar year). If you roll out your CVX stock to your brokerage account, you can rollover the remainder of your ESIP balance to an IRA in the same transaction or later in the same year. However, your ESIP balance must be $0 by year-end.

- You must experience a triggering event to qualify for NUA. Examples include death, disability, separation from service (retirement or termination) or reaching age 59½.

- The NUA distribution must be the very first withdrawal you take after retirement. If you take any other withdrawals prior to completing the NUA, you’ll lose the opportunity to take advantage of NUA and the tax savings that come along with it.

- If you take a withdrawal prior to retirement (for a loan or other reason), an NUA cannot be completed unless you wait until a triggering event has occurred. In this case, the triggering event must be either reaching age 59½ or death.

NUA can provide major tax advantages. However, like many tax-related guidelines issued by the IRS, applying it can be complicated and easily misunderstood. Unfortunately, because the qualifying rules can be misinterpreted, it’s not uncommon for Chevron employees and/or retirees to attempt to make a distribution of CVX stock and also give themselves a major headache and tax bill. Chevron has actually issued some guidance highlighting a few potential scenarios that can trip up employees and affect their retirement savings and strategies.

At Willis Johnson & Associates, we’ve helped many Chevron executives and professionals manage their retirement benefits and options.

We know Chevron employees' options, including NUA, to make the most tax-efficient decisions regarding their retirement savings. Learn more about the many ways we support Chevron executives and our process for guiding clients through their various life stages and financial needs.