It's a big year for you when you decide to retire from Shell. You've worked your entire career for this moment. The next stage is where you can enjoy what matters most — spending more time with family, taking vacations on your bucket list, or enjoying hobbies beyond the office.

But, the year you retire is often your most highly compensated one because of the benefit payouts that come after separation. Without a proper plan, these payments might sit in your bank account, losing value to inflation and hindering your long-term investment returns. Unfortunately, most retirees don't realize how much taxable income they should expect, how it will affect them, or what they should do differently.

Let's first look at the different retirement payouts for Shell retirees.

Sources of Retirement Income from Shell

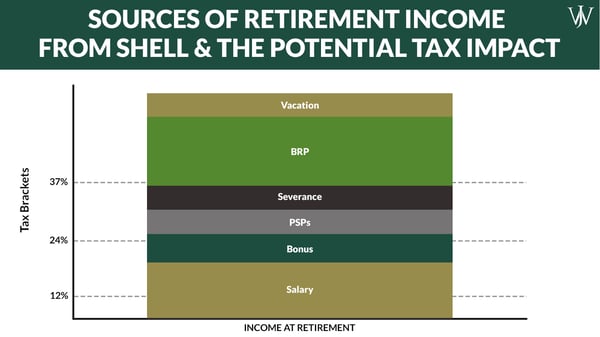

What income might you see in the year or year after retirement? The following is a list of payouts we commonly see with our Shell clients—most, if not all, of these impact taxable income for retirees.

- Severance- Shell may distribute your severance in one or two payments depending on your tenure. For more tenured employees, Shell may spread payments across the year of retirement and the following year, up to a year and a half of your salary.

- Vacation- Paid in the year of retirement

- Shell Bonus- Prorated for any work performed throughout the year and paid in the year of retirement.

- Shell Performance Shares- Paid for the prior year during the early part of the calendar year.

- Shell Pensions- This will depend on whether you're on the 80-point or APF pension. The 80-point pension and APF annuity option will increase taxes when payments are started and received. The APF Lump Sum option can allow retirees to defer taxes by depositing the pension funds into a retirement account, such as an IRA.

- Benefit Restoration Plans (BRPs)- You may have two types of BRPs: The Provident Fund BRP and the Pension BRP. Shell pays both plans out in cash ninety days after severing. These payouts can add up to substantial amounts for retirees.

Where do Shell Benefit Payments Go?

While some go to investment accounts, most of these retirement payments go straight to the bank account where Shell deposits your paycheck. That doesn't sound too bad — A little extra cash in your bank account to start your retirement with a bang? While extra money is never bad, what you do with this extra cash can have a significant impact on your retirement portfolio.

What to Do with Cash on Hand from Shell Retirement Benefits

While you can't always control when payments come to you after retirement, you can make a plan for what to do with them once they reach your bank account.

The overarching question for every retiree is: what is the right amount of cash? Generally, we recommend holding one to two years' worth of expenses (net of any regular income) in a cash reserve after retirement. It is crucial to identify the right amount to have on hand — You need enough cash to ride out a bad market, but you must also consider the cost amidst rising inflation. The right amount of money on hand is the number that is "just right," not too much or too little.

Cash Reserve Investment Strategy

Once you can confidently answer this question, other planning opportunities come to light. These include making retirement contributions with earned income and investing in an after-tax account.

Let's say your goal for your cash reserve is $150,000, and you receive fairly significant payouts of $300,000 after retirement. Our first step is planning to keep $150,000 in cash to fill up your reserve bucket. That means there's $150,000 of excess that we can plan around.

If you do nothing, the funds will lose value to inflation. For June 2022, the inflation number was 9.1%, the highest rate in 40 years. It's easy to read this and think doing something with the cash is an obvious action plan. But, we often see retirees who keep excess cash for far too long (sometimes years), missing out on potential market appreciation. As a retiree, you're busy enjoying life without work, and investments and financial planning are not a top priority in a busy year like this.

Advisor Tip: One way to strategically plan for these payouts is to systematically invest anything over your cash reserve threshold, which ensures that the funds are invested and working for you.

Retirement Payouts from Shell Benefits

We've talked about retirement payouts, but how much are some Shell retirees receiving in the year of retirement? It's probably more than you think.

Let's consider an example. Jennifer, 60, is retiring from Shell this year after 20 years with the company. Not only is she retiring, but she's retiring after accepting a severance package, which means Jennifer is in for a year of very high income. Higher than she may have ever had previously.

Let's look at all of her payouts and what her total income will be for this year.

- Partial Year Salary: $150,000

- Bonus from prior year: $30,000

- Pro-rated current year bonus: $15,000

- ½ severance for the current year: $250,000

- Performance Shares for the current year: 10,000

- 80-point pension payments in current year: $45,000

- 80-point pension BRP: $650,000

- Provident Fund BRP: $350,000

Total income for this year: $1.4m

Immediately after retirement, Jennifer goes into vacation mode to enjoy her newly-found free time with her family. Before retirement, she had about $50,000 in the bank. However, after the first 90 days of retirement, her bank account grew to $1.5m after Shell distributed approximately $1.4m in cash payments to her!

Jennifer decides she will do something about this, eventually. However, two years later, the cash still sits in her bank account. Her uninvested payments create a significant cash drag on her overall portfolio, and she's missed investment opportunities.

Tax Planning for Retirement

For illustration purposes, we didn't include taxes in this example. However, taxes are a critical element to consider when you retire.

Receiving retirement benefit payouts can be a significant taxable event. Unfortunately, many retirees do not withhold enough for taxes during the year they retire. One way to combat this is to increase your cash reserve to ensure you have enough money to pay taxes owed. At Willis Johnson and Associates, we do financial, investment, and tax planning with our clients continuously to ensure that we optimize their financial situation in retirement. We believe this is an integral part of a comprehensive financial plan and that an advisor should always review taxes in coordination with your overall financial plan.

How could this have been handled differently? We've talked about high-level concepts and what income might look like in the year of retirement. But, what are the quantifiable effects of retiring without a plan?

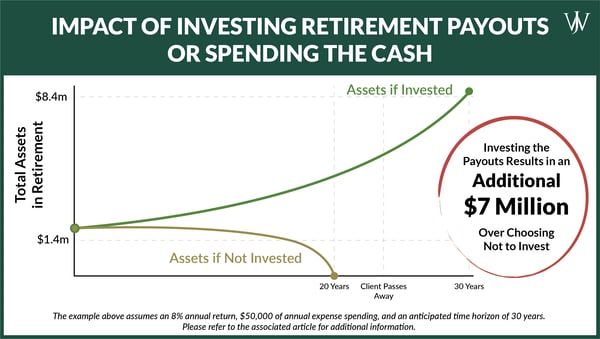

We saw above that Jennifer received $1.4m in retirement payouts into her bank account. So let's look at how she's affected if she keeps the $1.4m in cash versus creating a plan and investing it. In both examples, we'll assume an 8% annual return, $50,000 of yearly distributions for retirement income, and a time horizon of 30 years where Jennifer uses those funds.

Suppose Jennifer keeps these funds in cash and needs to withdraw $50,000 each year for expenses to supplement her pension and other income. In that case, she will quickly spend these funds down in a matter of 20 years. As a result, her retirement income will fall two years short of lasting her entire lifetime. All the while, she's losing spending power on her cash due to inflation. During times of high inflation, planning for excess cash is imperative.

So, what if, instead, Jennifer invested the funds and efficiently timed her withdrawals?

She could grow her original $1.4m in cash to $8.4m over the next 30 years, even while taking her withdrawals!

This growth can be hugely impactful for providing her flexibility in retirement to take more vacations, buy a second home, leave more to her children, or donate more to her favorite charity.

Retirement Planning for Shell Employees

For your financial well-being, doing nothing is not the answer. Make sure you do something when you receive these payouts, whether you decide to talk to a financial advisor like WJA or do your own research and planning. One thing we've found effective is to set a cash target and regularly move excess cash over to an investment account to invest. A systematic strategy helps keep cash from sitting in the bank for too long, losing value. Sometimes it's hard to think about investing a large sum of money into the market at one time. While studies show that lump sum investing tends to yield the best results most of the time, dollar cost averaging can be a great way to get money to work over a reasonable period.

When done correctly, financial and tax planning for retirement can make a substantial difference to your retirement portfolio. At WJA, we look at all your financial pieces together, so no opportunity is overlooked. Our firm focuses on comprehensive financial planning and ensuring we are proactive with retirement planning to help our clients reach their financial goals. While this ongoing planning may seem daunting during an already busy time in your life, you don't have to go it alone. Working with a financial advisor is a beneficial way to determine if this or other tax-efficient savings strategies can help you reach your long-term goals. Start the conversation with an advisor today.