Shell has a history of being a company that handsomely rewards its employees through a wide array of benefits ranging from company stock payouts, multiple retirement plan options, and more than competitive medical plan coverage. Outside of compensation, these extra benefits can improve their employees and their families' lives to and through retirement. However, of these benefits, the one most Shell employees and retirees are not as familiar with is the Shell Learning account and the opportunities it brings for personal and professional development.

What's the Shell Learning Account?

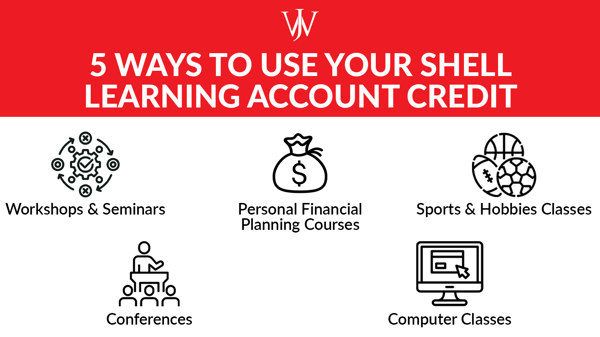

The Shell Retirement Learning Account is a $1,000 credit that retirees or employees leaving Shell can use if they are within their first year of retirement. Retirees can use the Learning Account to cover costs for courses, seminars, conferences, or workshops that interest them and are related to retirement.

It's equally important to understand what the Learning Account cannot cover and how to receive the reimbursement. When working with our Shell clients, we often discuss how they can use this benefit to enhance their life. Learn more about the Shell Learning Credit here, on page 178.

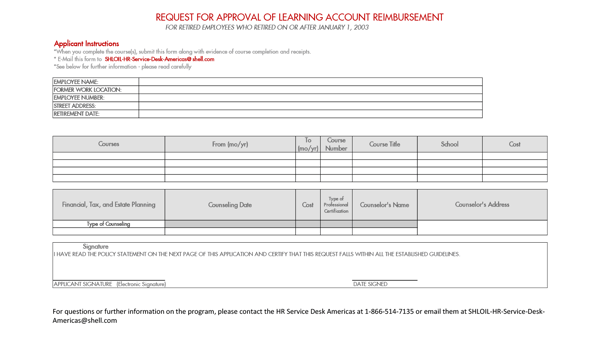

Additionally, we want to ensure that our clients take full advantage of this credit since it's basically free money offered by Shell. However, since the benefit isn't as well-known as the Provident Fund or the pension, we also assist clients in getting reimbursed by the company when leveraging the benefit. You can find the reimbursement form for the Learning Account here. When evaluating the available resources Shell offers its retirees, it's crucial to avoid leaving any of them on the table so you can experience the full benefit of the programs and benefits.

What does the Shell Learning Account Cover?

For employees receiving severance or taking leave

When an employee doesn't get to pick their retirement date, takes a leave of absence, or is offered a severance package, it's often difficult for both the employee and their family. Because these scenarios can bring emotional challenges for the employee and their family, one usage for the credit is to cover courses in the psychology of retirement by a licensed professional.

For retirees

For retirees within their first year of retirement, Shell provides the Learning Account to offer funds to explore hobbies and develop additional skills. Depending on the subject matter and provider, these funds can cover multiple recreation or skill development courses. If you've ever wanted to learn to paint, become a yoga instructor, or master computer skills, you can use the credit to explore or begin to explore these desired aspirations.

A common concern for many retirees on their last day is whether they have enough money to retire. To address this concern, retirees can also use the benefit for courses in financial planning to provide a powerful level of peace of mind. However, one caveat with the Shell Learning Account is that you cannot use it to cover the cost of items such as books, equipment, and tools.

Using the Shell Learning Account for Financial Planning

Suppose you want to use the Learning Account for financial planning. The money in the plan can be used for personal financial planning courses or courses on taxes and estate planning, but evaluating the provider of this guidance is crucial. Knowing the differences between tailored financial planning and general financial advice is essential. Not all advisors are held to the same standards or regulations, so it can be challenging to understand their differences.

For example, Willis Johnson and Associates is a planning-led firm that holds its financial professionals to the highest standard in the industry. As a fee-only RIA, our firm maintains the fiduciary standard, which you can learn more about here. The financial advisors on our team are required to hold one or multiple licenses, with the most common designation being the CFP(R). We lead with financial planning ideas and are happy to help Shell retirees determine if they are financially secure to retire and what that retirement will look like.

Working with a Financial Advisor on Shell Retirement Planning

Shell is a leader in providing benefits for its employees, but it's challenging for many employees to understand the intricacies and details of each one. Investments in the Provident Fund, differences in the 80 point versus the APF pension, Performance Share vesting, Benefit Restoration Plans, Insurance options, taking a lump sum versus an annuity payout -- the vast number of programs and considerations can be daunting, to say the least.

Many leave Shell's Learning Account out of the mix, but they shouldn't. Coordinating all the resources Shell offers to employees and retirees and using them effectively can be challenging, but it can also be rewarding as you reap the benefits you've worked so hard for. At Willis Johnson & Associates, we work with our Shell clients and retirees to coordinate these benefits into their overarching financial plan while keeping their goals for their future at the forefront of our planning. Having a plan for retirement is often what can offer the most significant piece of mind amidst the changes that come with transitioning into retirement. To discuss how you can leverage your Shell benefits to accomplish your financial goals, take advantage of our complimentary consultation with one of our Shell experts today.