Bonus time can be exhilarating – a large lump sum of cash that Chevron employees can use for many expenses – paying off debt, taking a vacation, or hiding under the mattress for a rainy day. But for Chevron super-savers, there are many additional strategies to help you maximize your bonus payout.

What is the Chevron Incentive Plan (CIP)?

The Chevron Incentive Plan (CIP) is Chevron's short-term cash incentive program. Colloquially, many Chevron employees refer to the CIP as the annual Chevron bonus.

Chevron CIP Formula & Calculation Factors

Chevron bases an individual's CIP bonus on the employee's job grade, individual performance, and the company's annual performance. Chevron reviews many factors when determining company performance, including comparing the company to top performers in the Oil Industry Peer Group. In years where Chevron's overall performance has been high, the bonus payouts have been higher.

In 2025, we expect to see a lower bonus payout than in recent years, as projections for Chevron's earnings declined in 2024 compared to the previous year. With this impending bonus payout for Chevron employees, it is important to note how this additional income will impact your cash flow, retirement savings, and taxes.

How is Your Chevron Bonus Taxed?

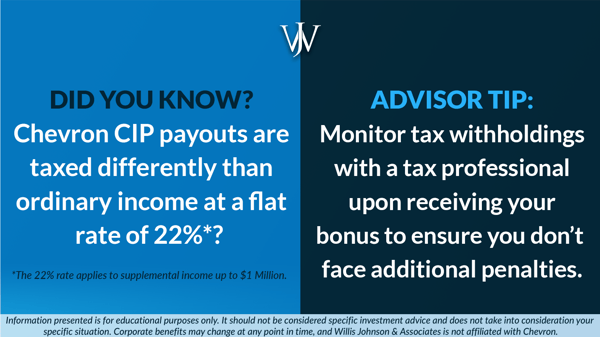

When you receive your bonus, it's an excellent time to check in on your tax withholding. It's essential to ensure that you are withholding enough in taxes from your paychecks and bonus, so you do not need to make an estimated tax payment for Q1. The last thing you want to deal with is an additional tax penalty on top of your tax bill come April 2025.

Additionally, since CIP payouts are considered supplemental income, they are taxed differently than ordinary income. The IRS taxes supplemental income, like bonuses, up to $1 million at a flat withholding rate of 22%. If you are a high-income earner at Chevron, 22% may not be enough withholding to cover your tax bill without additional penalties. Therefore, it's essential to work with a tax professional who can check in on your ongoing tax withholding and help you calculate any extra payments you may owe after you receive your bonus.

How the CIP Impacts the Chevron Pension (CRP)

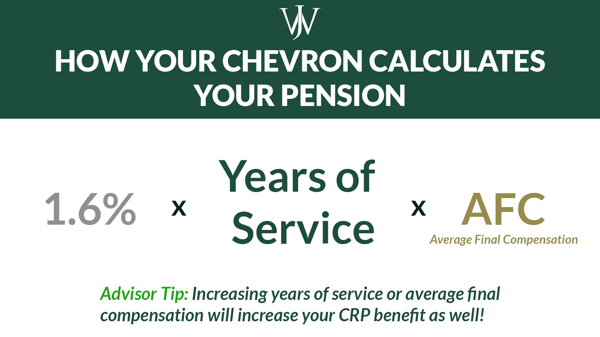

If retirement is near the horizon, consider how your next CIP payout may affect your pension calculation.

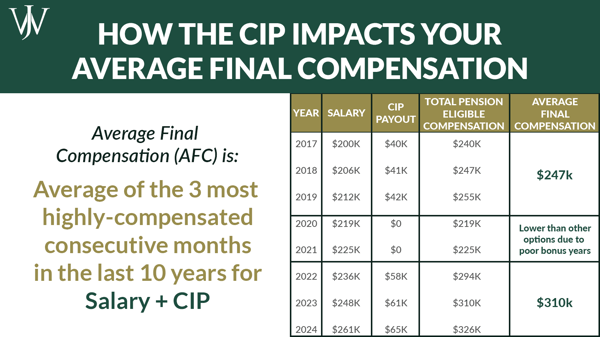

The Chevron Retirement Plan (CRP) formula considers your years of service and Average Final Compensation (AFC). If either of those variables increases, the pension value increases. Chevron averages the 36 most highly compensated consecutive months in the last ten years when reviewing AFC for an upcoming retiree. A larger bonus payout for this year could increase the AFC over the previous 36 months for an impending retiree.

For the CRP calculation, a crucial caveat is that Chevron employees who want their AFC to include the March 2025 CIP must be on the U.S. payroll for at least one day in April 2025. Chevron provides retirees prorated bonuses for work completed in their year of retirement so long as the employee works for at least one day in the next quarter. So, for example, if someone retired on July 1st, 2025, they'd receive a 50% prorated bonus, and if they retired on October 1st, 2025, they'd receive a 75% prorated bonus. Given that timeline, it would be prudent to review your AFC and determine whether it would be valuable to stay on the payroll until the first day of an upcoming quarter to maximize the AFC for your pension.

How to Invest Your Chevron Incentive Plan Payouts

When talking to Chevron supersavers, a common question arises, “should I invest my bonus or save it in a certain account?” The answer depends on an individual’s unique circumstances and goals. However, the following strategies are considerations we discuss widely as ways to consider leveraging the CIP payout each April.

Invest Excess Cash To Avoid Tax Drag from Inflation

Having a cash reserve for emergencies is critical to sound financial planning, but carrying too much cash can be detrimental to a plan. You need to earn 3.1% from investments to break even on the purchasing power of your cash.

With the CIP payout in March 2025, it would be prudent to review your cash holdings and determine if you should reinvest any funds, allowing growth to surpass inflation. And with the market currently pulled back from all-time highs, investing cash in this pullback could be an excellent investment decision.

Make Contributions to Your Chevron 401(k)

Since the bonus payouts occur in March, you should plan to check your 401(k) contributions before and after the bonus payout. You may consider contributing more to pre-tax or supplemental with your CIP payout, especially if you know you will reach or exceed 2025's income limit of $350,000 before maxing out your ESIP. Front-loading contributions with the CIP will ensure you max out your pre-tax, after-tax, and company contributions before reaching this $350,000 income limitation.

After the bonus payout, you will want to check your year-to-date ESIP contributions to determine if you need to adjust your future supplemental contribution percentages to max out pre-tax contributions of $23,500 if you are under 50 or $31,000 if you're over 50, as well as your after-tax contributions. Your total after-tax contribution amount will vary annually depending on your salary and CIP payout. Your total after-tax contribution amount is the difference between the overall 401(k) contribution limit and the sum of your pre-tax contributions and your 8% company match (if contributing 2% to basic).

Leverage Backdoor Roth Contributions

You have several options for where you can invest excess cash. For example, if you've maxed out your 401(k), you may consider contributing to an after-tax account or making a backdoor Roth contribution. A backdoor Roth contribution allows you to roll your excess cash over into a Roth IRA to take advantage of long-term tax-free growth, even if you're above income limits that prevent you from directly contributing to a Roth.

Backdoor Roth Contributions allow individuals to make a nondeductible IRA contribution of $7,000 if under 50 or $8,000 if over 50. Once you contribute to the IRA, you convert the IRA to a Roth IRA. Once funds are available in the Roth IRA, you can invest the cash in an equity-heavy allocation, which can be a great solution to get cash working towards tax-free growth. There are currently no income limits on nondeductible IRA contributions, so individuals over the income limit to directly contribute to a Roth IRA can still use this Backdoor Roth strategy.

Reduce Taxable Income Through Charitable Giving

A more significant bonus may result in a higher-than-average income year and a significantly higher tax bill. While working, you can pull a few levers to minimize your tax bill – max out pre-tax retirement savings accounts, deduct property taxes up to $10,000, deduct mortgage interest on up to $1m of debt, and deduct charitable donations.

If you are charitably inclined, making a significant charitable gift in a year of high income can be incredibly beneficial to lowering your tax bill. You could consider direct contributions to a charity or a Donor-Advised Fund (DAF) to bundle your charitable gifts into more significant lump sum donations. To maximize the tax efficiency of your contribution, consider donating appreciated stock instead of cash. You can gift appreciated stock directly to a charity or a DAF, which offers you an itemized deduction on your tax return and avoids the capital gains taxes on the stock. With your cash CIP payout, you can replace the stock value with cash and either reinvest in the same stock or diversify elsewhere.

Make Your Investments Go Further by Working with a Financial Advisor

CIP payouts every spring are exciting, but it's important to invest them in the things that matter most to you and your family. At Willis Johnson and Associates, we can help maximize your annual performance bonus for the journey ahead through tax planning, savings prioritization, and benefits eligibility assessment. Partnering with an advisor who understands your financial needs for today can add tremendous value in helping you establish financial systems to support your future goals. Get started today by discussing your financial goals and Chevron benefits with the advisors at WJA who can offer tailored guidance to help you reach financial independence.