Recent Posts

Featured Post:

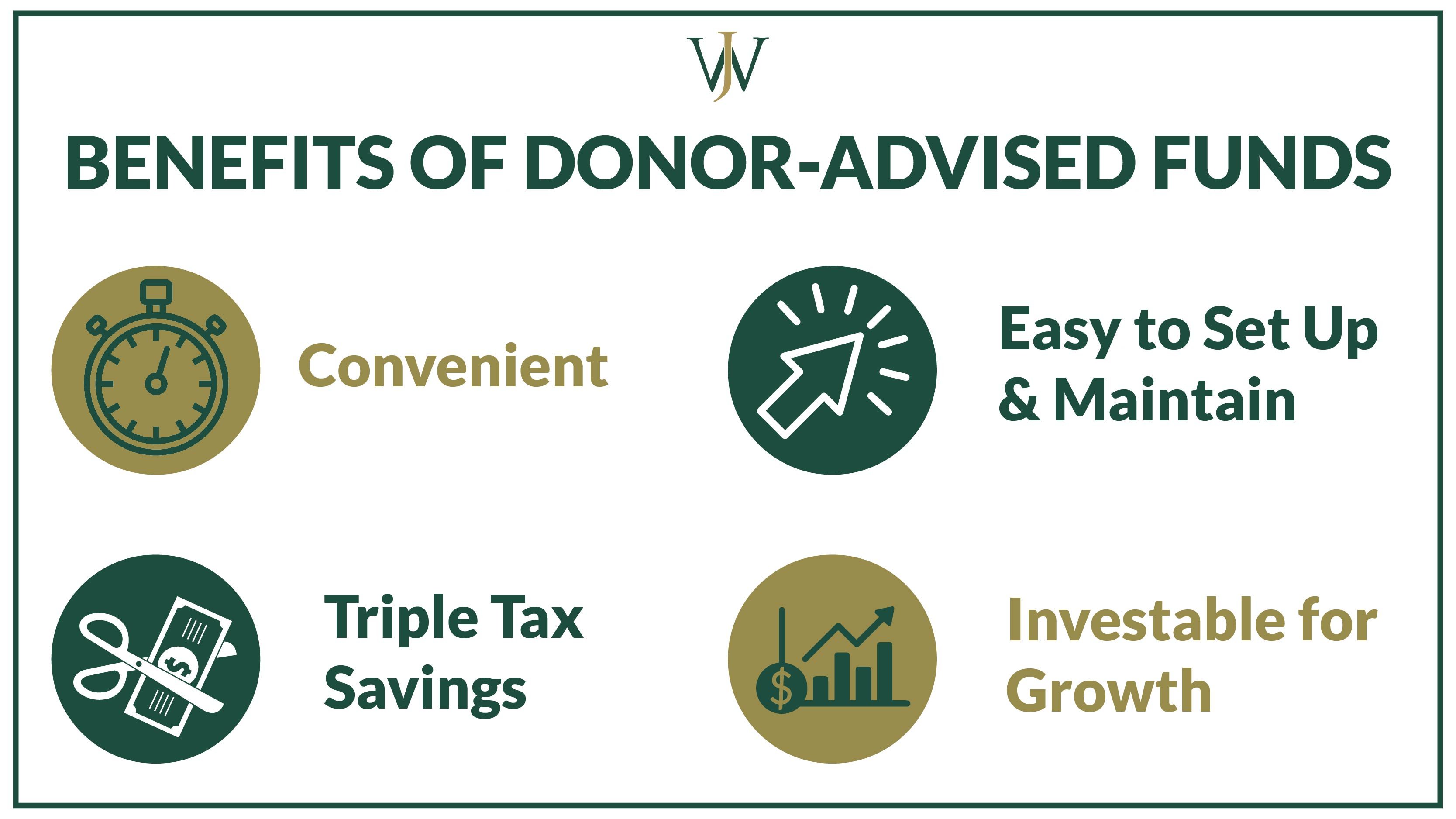

Why Now Is the Time for Donor-Advised Funds Before 2026 Tax Changes Hit

High-income families and philanthropic investors are increasingly turning todonor-advised funds (DAFs)tosupport the causes they care about, while also reducing taxes. DAFs enable donors to contribute...

Benefits of Filing a Tax Extension for High-Income Earners

by Leah Cessna, CPA

March 13, 2025

Understanding the FBAR: Foreign Asset Reporting & Tax Penalties

by Leah Cessna, CPA

March 13, 2025

How to Avoid Double Taxation on Restricted Stock Units (RSUs)

by Leah Cessna, CPA

February 04, 2025

Common Tax Mistakes High-Income Earners Make That Add Up Over Time

by Leah Cessna, CPA

January 23, 2025

Self-Employment Tax Considerations When Starting a Consulting Business

by Leah Cessna, CPA

June 24, 2024

6 Strategies to Reduce Taxable Income for High-Earners

by Leah Cessna, CPA

August 21, 2023

6 Things Expats Need to Know About Taxes Before Moving Abroad

by Leah Cessna, CPA

August 08, 2023

Secure 2.0 & Its Impact on Your Financial Planning

by Leah Cessna, CPA

February 14, 2023

How U.S. Expatriates Can Avoid Costly Tax Penalties or Double-Taxation Abroad

by Leah Cessna, CPA

November 10, 2020

Tax Loss Harvesting: How to Benefit From Your Investment Losses

by Leah Cessna, CPA

October 19, 2020