Recent Posts

Featured Post:

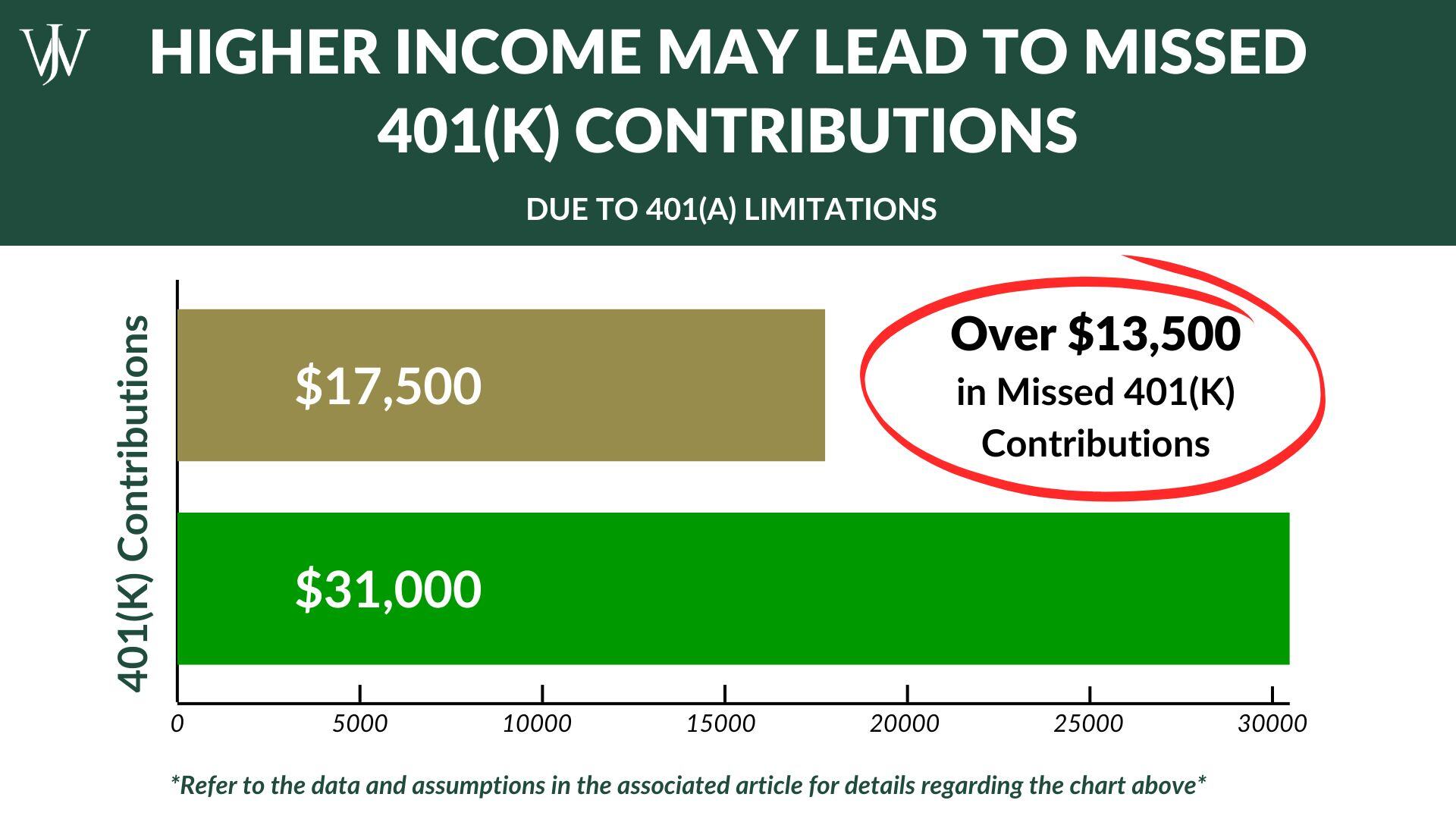

401(K) Income Limits: The Mistake Professionals Earning Over $350,000 Often Make

Many executives believe that they're maxing out their 401(k) contributions year after year. However, due to the IRS' 2025 401(a)(17) limitation of $350,000 in income and the impact it has on both...

Tax Cuts & Jobs Act: The Basics

by Nick Johnson, CFA®, CFP®

January 09, 2018

401(k) Loans vs. Home Equity Loans: The Real Cost of Borrowing from Your 401(k)

by Nick Johnson, CFA®, CFP®

November 14, 2017

Hurricane Harvey Help and Advice

by Nick Johnson, CFA®, CFP®

September 07, 2017

Sequence of Return Risk and Planning for Your Retirement Future

by Nick Johnson, CFA®, CFP®

July 11, 2017

Who is going to be there for you if your advisor retires?

by Nick Johnson, CFA®, CFP®

June 06, 2017

Is Your Portfolio Prepared If You Spend 30-40 Years In Retirement?

by Nick Johnson, CFA®, CFP®

April 06, 2017

Why IRS Announcement 2014-32 is Causing Tax Problems for Retirees

by Nick Johnson, CFA®, CFP®

October 12, 2016

Setting Realistic Real Return Expectations

by Nick Johnson, CFA®, CFP®

April 12, 2016

What You Need to Know About 83(b) Elections & Performance Shares

by Nick Johnson, CFA®, CFP®

March 18, 2016

Morningstar's Pension Lump Sum or Annuity Video

by Nick Johnson, CFA®, CFP®

December 22, 2015