When setting your long-term financial goals, it's important to understand the fundamentals of an investment strategy if you plan to use the stock market to help you reach them. There's more to investing than the old adage of "buy low, sell high" or trying to time the market perfectly.

In fact, according to a study done by Brinson, Singer, and Beebower, "Asset Allocation is the primary driver of performance comprising 93.6% of returns," not an individual security or asset class. There are a few steps to take before determining the right asset allocation for you, so let's dive in.

What is Asset Allocation in an Investment Portfolio?

Asset allocation is an investment strategy that leverages risk, reward, and diversification against one another in a portfolio. Another way to look at it is – asset allocation is the pre-determined mix of stocks, bonds, cash, and mutual funds within your portfolio. For those looking to grow their investments over time to eventually use in retirement, utilizing a pre-determined asset allocation strategy can offer confidence and peace of mind as it becomes increasingly difficult to differentiate between the various stocks, bonds, and mutual funds options to invest in as one-off investments. Using this strategy, you can prioritize asset classes rather than individual stocks to invest in while staying within your desired risk levels.

The Role of Diversification Alongside Your Asset Allocation

One of the key components to any asset allocation strategy is diversification. Diversification of your investments allows you to reduce your exposure to specific types of risk. A well-diversified portfolio can keep you afloat in volatile years and can help you reach your long-term financial goals for when you need to live off of it later. Let’s consider an example:

Let’s say you and a friend of yours have investment portfolios, but your portfolio is heavily weighted in your company’s energy stock while your friend is more diversified across energy, fixed income, technology, and emerging market equities. If we looked at each of your portfolios in early 2020, we’d see that your portfolio likely took a hard hit due to the fall of energy stocks in the first and second quarters; however, your friend with a more diversified portfolio likely saw less of a dip in their overall portfolio value and may have even witnessed some gains in the market sectors that ran during the COVID-19 crisis.

Oftentimes, your exposure to risk amplifies within asset classes and their respective subclasses when your portfolio includes a disproportionate amount of one asset class or another. Diversification goes further than just having both stocks and bonds in your portfolio. At Willis Johnson & Associates, we encourage our clients to diversify both across asset classes and across many of the subclasses as well for both a breadth and depth of coverage. Understanding how to leverage your asset allocation within your portfolio is a crucial component of any investing strategy since it’s known to be a key driver of performance according to Beebower, Brinson & Singer.

How to Make the Most of Your Asset Allocation

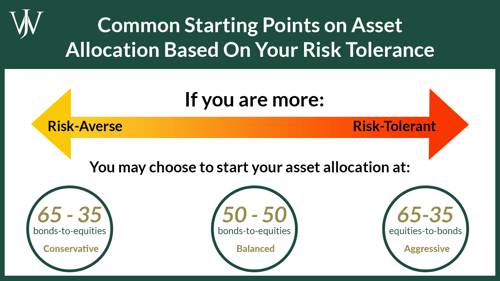

When considering your approach to investing and determining the right allocation for you, it’s important to start with the end goal in mind. Do you need a certain amount for retirement? Are you hoping to pass on a certain amount to the next generation? Answering these types of questions while also understanding the level of risk you’re willing to take on are the crucial first steps to determining your asset allocation. When looking at various asset allocations, there are three common starting points to consider.

How to Start – Determine Your Risk Threshold & Investment Style

-

- Aggressive – If you’re willing to take on more risk to achieve more growth in your investments, we often describe your asset allocation as more aggressive. A colloquial way to think of this strategy is “more risk for more reward.” A common starting asset allocation for aggressive investors is a 65-35 equities-to-bonds ratio, but if 65% equities doesn’t seem high enough to achieve your desired growth, you can always decide to take on more risk by adding equities to your portfolio. Sometimes, investors with a long time horizon (the time until they’ll need the money from their investments) believe that they can afford the additional risk, but that’s not always the case. A significant factor to consider when deciding if you want to take on those extra equities is that because they are significantly riskier, you could also stand to lose more value if we enter a downturn.

- Conservative – For those who are more risk-averse tend to carry more fixed income in a portfolio to achieve their desired growth, we often describe this asset allocation as more conservative. Rather than the “more risk, more reward” approach of aggressive investors, the conservative approach tends to lean towards “slow and steady wins the race.” A common starting point for a conservative asset is the opposite of the aggressive asset allocation – 65-35 bonds-to-equities. Similarly, if that proportion doesn’t seem right, you can decide if you’d rather carry more or less fixed income or equities in your portfolio to reach your goals. We often see investors taking a conservative approach when their time horizon is shorter or if their need for the money in the portfolio is approaching. A key consideration for those looking to use a conservative asset allocation is that while this approach tends to be how people want to invest to avoid extra unnecessary risks, it may not help them reach the amount needed in retirement to maintain their desired lifestyle.

- Balanced – For those looking for a place to start that balances the two approaches above, we’d describe your asset allocation as "balanced". A good place to start for a balanced asset allocation is 50-50 equities-to-bonds. From there, you can adjust and add either fixed income or equities until you reach the risk and growth thresholds you’re most comfortable with.

- Aggressive – If you’re willing to take on more risk to achieve more growth in your investments, we often describe your asset allocation as more aggressive. A colloquial way to think of this strategy is “more risk for more reward.” A common starting asset allocation for aggressive investors is a 65-35 equities-to-bonds ratio, but if 65% equities doesn’t seem high enough to achieve your desired growth, you can always decide to take on more risk by adding equities to your portfolio. Sometimes, investors with a long time horizon (the time until they’ll need the money from their investments) believe that they can afford the additional risk, but that’s not always the case. A significant factor to consider when deciding if you want to take on those extra equities is that because they are significantly riskier, you could also stand to lose more value if we enter a downturn.

How to Maintain Your Asset Allocation Through Target Band Rebalancing

While we’ve pointed out that determining the right asset allocation is crucial to any investment strategy, maintaining your asset allocation over time is arguably more important. As the market shifts, the weight of your holdings within a portfolio can shift in kind and move you away from your desired allocations. We use a strategy called Target Band Rebalancing with our clients to keep them within preferred risk allowances.

Using Target Band Rebalancing To Stay Within Your Preferred Risk Tolerance

A strategy we like to use with our client’s portfolios is called Target Band Rebalancing, or Opportunistic Target Band Rebalancing, which helps them stay within a desired range of their asset allocation. Oftentimes, market dips and runs can cause the weight of a portfolio’s holdings to shift and can expose an investor to more or less than their desired risk. By setting up desired thresholds or “target bands” around a desired asset allocation, this strategy enables us to trim profits and capitalize on a market run-up or to buy recently beaten-up positions at a lower cost during a downturn which both help return to the portfolio’s desired allocation.Learn How To Use Target Band Rebalancing with Your Investments Here >>

Asset allocation is a core tenet of an investment strategy and can have a huge impact on long-term returns. Managing your exposure to risk is critical in making sure your investments are working for you over time. As the market shifts and you move into various stages of your life, it’s often necessary for your asset allocation and investment strategy to evolve as well. If you want a second opinion on your portfolio or recommendations on the right asset allocation for you, get in touch with us and our advisors can offer guidance on the right strategy to help you reach your financial goals.