One of the big questions we are asked as our clients look to retirement is: Where should I withdraw from first? This may seem like a simple question, but the answer is it depends.

Regular tax planning is required to understand how to efficiently spend from your portfolio during retirement. Why is this important? Without proper planning, you can miss out on ways to optimize your current and future tax situation and as well as lose out on compound growth in your tax-beneficial accounts.

We often see misconceptions regarding retirement spending. Most people believe and have been told that they should first spend from their retirement accounts (IRAs, Roths, 401ks): that is, in fact, why they made so many contributions to these accounts during their working years, right?

This is not necessarily incorrect. However, there are additional factors to consider when deciding where to draw from and when during your years of retirement. These considerations should include your overall financial situation and portfolio structure, your annual tax situation, and your estate plan with an emphasis on to whom the funds will transfer when you pass. If there are ways to optimize your current and future taxes, they might be missed if you aren’t taking the above items into account.

Retirement Income & Its Impact on Your Tax Rate

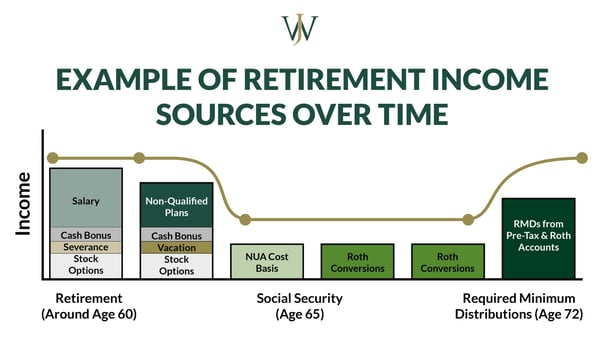

At the inception of retirement, there’s usually a noticeable drop in one’s tax rate. Generally, there's a sigh of relief from retirees without any thought as to what it may mean for their future taxes. Soon after, retirees start Social Security and see a slight uptick in their tax bracket. When retirees see age 72, the big tax bill comes back with a vengeance as Required Minimum Distributions are taken from pre-tax retirement accounts (IRAs and 401ks). Depending on your financial and tax situation, this is something that could have been mitigated during those years of lower income after retirement.

Understand Your Retirement Accounts and Their Benefits

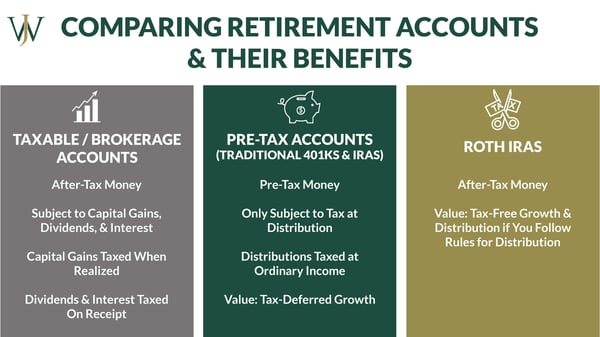

Before we dive into current and future tax mitigation strategies for retirees, let’s look at the types of accounts within a retiree’s portfolio and review the corresponding benefits of each account:

- Taxable account/Brokerage account- These are after-tax dollars that are subject to capital gains, dividends, and interest. Dividends and interest are taxed when received. Capital gains are taxed when realized.

- Pre-Tax account (Traditional IRAs and 401ks)- These are generally pre-tax dollars that are only subject to tax at distribution. Distributions are classified as ordinary income and will be taxed as such. The value of pre-tax accounts is the tax-deferred growth.

- Roth IRAs- These are after-tax dollars that grow tax-free and incur no tax at distribution as long as you adhere to the distribution rules.

Which Retirement Withdrawal Strategies Should Retirees Leverage First?

Retiree withdrawal strategies are not one-size-fits-all. They are different for each individual and need to be reassessed annually to ensure that you are being efficient and effective with your withdrawals and the implementation of optimizing strategies.

Years of low income provide opportunities to take advantage of tax strategies like Roth conversions or the 0% capital gains tax bracket.

Roth Conversions

Roth conversions take IRA pre-tax funds and convert them to Roth. Taxes are paid at the time of conversion.

Why would you want to pay more taxes now?

This strategy takes advantage of your low tax bracket now to pay taxes on pre-tax money at lower rates. These funds, if left alone, will be forced from your pre-tax accounts starting at age 72, but your tax bracket will be higher when this happens. In essence, not only are you getting money into Roth to grow tax-free, but you are also decreasing your future taxes by paying some additional taxes now.

When do Roth Conversions make sense?

They make sense if you are in a lower income tax bracket now than you will be in the future. They also make sense if you have a long investment horizon for your Roth IRA or you have a natural person to which you plan to leave the account. These accounts are wonderful for tax-free growth as well as tax-free distributions for the owner and beneficiary.

Utilizing the 0% Capital Gains Bracket in Retirement

Some retirees’ income is low enough to place them in the 0% capital gains bracket.

Why is this important?

It allows the recognition of capital gains in your taxable account without incurring tax on the gains. These proceeds can be used to cover expenses or re-invested to allow for rebalancing of the taxable account which is sometimes difficult to do when there are significant capital gains on certain holdings. As mentioned, this strategy makes a lot of sense if you have large unrealized long-term capital gains in your taxable account. Recognition of long-term capital gains can also be avoided (keeping income lower) by donating appreciated stock to charity. This helps to optimize your current and future tax situation if you are in a position to make a charitable donation.

What do these two strategies have in common when we think about withdrawals?

Either strategy would lend itself to making distributions from the taxable accounts to keep income tax and capital gains tax brackets low. This is because distributions from pre-tax accounts cause ordinary income, raising the overall income level and decreasing the ability to fully take advantage of the strategies listed above. This refutes the common thought that it’s always best to draw from retirement accounts first. Drawing from the taxable account first also allows pre-tax accounts to continue to grow and compound on a tax-deferred basis.

How to Choose Whether Roth Conversions or Using the 0% Capital Gains Bracket is Right For You

The strategies listed above require planning and regular review. So, what is the actual added benefit of thinking through withdrawals and the utilization of tax strategies? Is it worth it?

Jim and Julie, aged 65, are married and have just retired.

- They have pension benefits of $40,000 per year

- $10,000 in dividend income

- Pre-tax funds (401k and IRA) of $1,750,000

- Brokerage account with $300,000

- We will assume they average an 8% return on their investments

Looking at present tax brackets, Jim and Julie’s income puts them in the 12% marginal tax bracket as they are Married Filing Jointly. This tax situation affords them the ability to take advantage of partial Roth conversions or realize capital gains at the 0% capital gains bracket.

Let’s review an example exploring each path:

- Partial Roth Conversions-

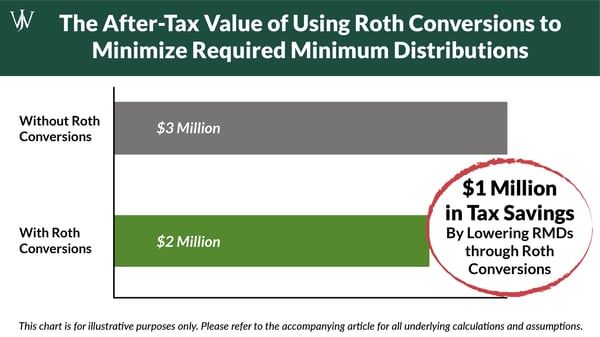

If Jim and Julie convert an average of $75,000 per year from 2021 through 2027 (the year before required minimum distributions begin), they will increase their current ordinary income tax bracket from 12% to 22%. However, this keeps their future marginal tax rate from climbing all the way to 32% because there will be a smaller amount of pre-tax funds forced out by required minimum distributions. At age 72, their pre-tax accounts are projected to grow to $3m without Roth conversions and, with Roth conversions, the accounts are only projected to grow to $2m. The funds that have been converted to Roth will grow tax-free with no required distributions. By decreasing required minimum distributions through Roth conversions, it helps to prevent Jim and Julie from being forced to distribute more funds than they need for expenses each year. The after-tax benefit of these conversions and raising current taxes to decrease future taxes is $1m.

- 0% Capital Gains Bracket -

Let’s say that Julie and Jim have substantial unrealized, long-term capital gains in their brokerage account. They have $22,200 of Taxable Income, which is at the bottom of the 12% tax bracket. Luckily for them, the 0% capital gains tax bracket threshold is $80,800 of taxable income. Therefore, they have ample room to realize gains up to $58,000 this year without incurring any taxes on these gains.

This is a form of tax arbitrage in that Jim and Julie are realizing the gains while they are within the 0% capital gains bracket as opposed to waiting until their income rises to the 24%- and 32%-ordinary income tax brackets (with corresponding 15% and 18.8% capital gains tax). Recognizing the same amount of capital gains ($58,000) in a year where the marginal tax bracket is 32% would result in almost $11,000 in taxes. Therefore, they saved $11,000 in future taxes simply by spending from their taxable account first and taking advantage of their 0% capital gains rate. Additionally, by stepping up the basis on their stock (realizing the gains now) it is easier to tap their taxable accounts in the future for expense needs without incurring future tax penalties.

Additional Tax Brackets to Consider for Retirement Planning

These are just a couple of examples to urge you to stop and think about where your money is coming from in retirement. As mentioned before, each tax and financial situation is different and your corresponding strategy will vary from year to year. Your Adjusted Gross Income, Deductions, and Taxable Income will help to determine the most efficient places from which to pull funds. Adjusted Gross Income is important because it determines your Medicare tax bracket. We can use the income tax bracket along with the Medicare bracket to determine the optimal amount for Roth conversions or income recognition in a given year. Social Security is also another item to take into consideration as it increases income.

For those who have low taxable income and want to leave money to heirs, they could consider spending their taxable money first while taking advantage of Roth Conversions. For those with large unrealized long-term capital gains, they could consider spending their taxable money first to recognize gains in the 0% bracket. Often, these two strategies can be staggered in different years.

At Willis Johnson and Associates, we do tax planning with our clients on a continuous basis to ensure that we are optimizing their financial situation in retirement. We work with each client to create an interactive tax analysis that we review together each year which helps us to decide on a tax strategy for the year ahead. This not only helps us with tax planning, but also investment and distribution planning. We believe that this is an integral part of a comprehensive financial plan and we believe that taxes should always be reviewed in coordination with your overall financial plan. At WJA, we look at all of your financial pieces together so that no opportunity is overlooked.

While this seems like a complicated and time-intensive process, when done correctly, this strategy can make a substantial difference in taxes and savings over time. Assessing the optimal withdrawal strategy in retirement helps our clients realize tax benefits that can significantly augment their portfolios for their own retirement goals or their beneficiaries. Working with a financial advisor is beneficial to determine if this or other tax-efficient savings strategies can help you reach your long-term goals. Start the conversation with an advisor today.