When it comes to financial goals, two of the most common are: save more for retirement, and pay less in taxes. For many, a Roth IRA is a great option to achieve those goals, but for high-income earners, there are income limits prohibiting them from taking advantage of the benefits presented by a traditional Roth IRA directly. That's where the Backdoor Roth contribution strategy comes into play.

What is a Backdoor Roth IRA Contribution?

A backdoor Roth strategy allows you to bypass the IRS' income limitations on Roth contributions to save an additional $7,500 annually ($8,600 if over age 50) above what you're saving in your 401(k) using the pre-tax, Roth, or after-tax sources. To yield these benefits, the Backdoor Roth IRA contribution strategy marries a contribution to a non-deductible IRA with a conversion to a Roth IRA.

IRA & Roth IRA Income Limits and Loopholes

When contributing to a traditional IRA, there are phase-out limits for those exceeding certain income thresholds to write off these contributions on their tax returns. The tax deductibility phase-out limit in 2026 for a traditional IRA ranges from $81,000-$91,000 for Single or Head of Household filers or from $129,000 - $149,000 for those who are Married Filing Jointly, assuming everyone in either case is covered by a retirement plan through work. When making any contributions to an IRA after these thresholds, the contributions will be designated as non-deductible after-tax contributions. There are no income limits for making after-tax contributions to a traditional IRA.

The income phase-out limit for married couples filing jointly to contribute to a Roth IRA (during the 2026 tax year) is $242,000-$252,000, and for Single or Head of Household, the income limit for contributing to a Roth is $153,000-$168,000. While these income limits prevent contributing to a Roth directly, there are no income limits for converting traditional IRA assets to a Roth IRA.

How to Do a Backdoor Roth IRA Contribution

The backdoor Roth contribution utilizes two accounts— a traditional IRA and a Roth IRA. If you are a high-income earner, you probably already know that you can’t contribute directly to a Roth IRA. The backdoor Roth contribution strategy is a way to get around the income limitation and still save money in a Roth IRA.

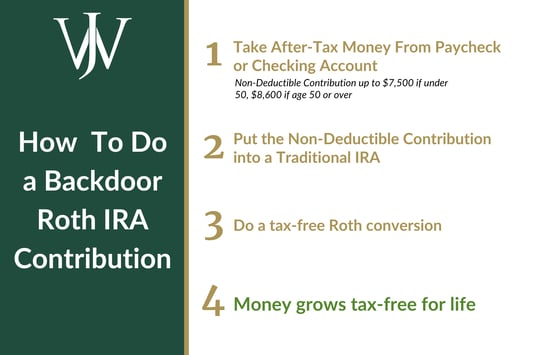

A simplified way of looking at the backdoor Roth process is:

-

- You receive your paycheck into your checking account, which is after-tax because you've paid your income taxes on it.

- You set up a traditional IRA account, and you also set up a Roth IRA account.

- You write a check for $7,500 that you deposit into your IRA. Since the money that you are contributing to the IRA is after you've already paid your taxes, it's considered an after-tax contribution. It also is considered a non-deductible contribution which means when you file your taxes in April or October, you don't get to write-off the contribution on your tax return, so it's considered a non-deductible after-tax contribution.

- Perform a Roth Conversion - Since the money in your IRA is after-tax money, when you convert your contribution to the Roth IRA, you do not pay any taxes on the conversion so long as there's been no growth on the contribution from the IRA and you convert it all to the Roth.

- Once the money is in the Roth, you invest it, and it grows tax-free forever. The backdoor Roth strategy works especially well, coupled with the after-tax rollover strategy, also known as a Mega Backdoor Roth.

Benefits of a Backdoor Roth IRA for Retirement Savings

This strategy allows you to save up to $7,500 annually per person (including spouses), over and above what you are already contributing to your employer’s 401(k). Many investors can contribute $7,000 for the 2025 tax year (as long as the contribution is made before filing the 2026 tax return) and contribute $7,500 for the 2026 tax year. If you are married and under 50, that means $15,000 in additional retirement plan savings for 2026 and an additional $14,000 for 2025, for a total of $29,000 in additional retirement savings that will grow tax-free for life and are tax-free upon withdrawal.

If you’re age 50 or over, you can contribute $8,600 per person (including spouses) in 2026, and $8,000 per person in 2025, so if both you and your spouse max out this savings strategy in both 2025 and 2026, you’ll have a total of $33,200 in tax-efficient savings to draw from in retirement tax-free.

Challenges of Doing a Backdoor Roth Contribution Without Professional Guidance

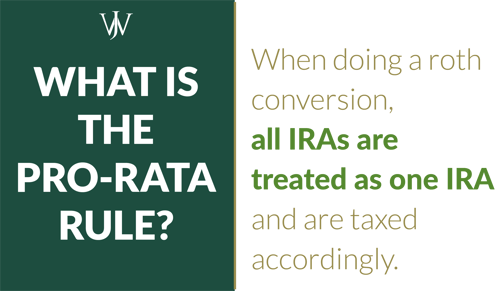

While the backdoor Roth may seem simple at a glance, some important stipulations and rules can have a significant tax impact if the strategy is performed incorrectly. Among the most important stipulations for traditional IRAs with pre-tax contributions is the pro rata rule, which treats all IRAs as one IRA. So, how can the pro-rata rule affect the outcome of using a Backdoor Roth IRA strategy? Let’s walk through an example of the consequences one may face upon completing a Backdoor Roth IRA contribution without proper planning:

Max has an IRA at Vanguard that contains $93,000 of pre-tax funds. He decides he wants to do a Backdoor Roth IRA contribution, so he opens an IRA at Fidelity. Max contributes $7,500 of non-deductible money and immediately proceeds to convert the money to his Roth IRA at Fidelity. Max thinks that he will not owe any taxes on the conversion because he converted money from his Fidelity IRA to his Fidelity Roth IRA. However, he did not understand the pro-rata rule before making this financial decision.

The pro-rata rule says that all IRAs are treated as one IRA for the purposes of Roth Conversions. So, in reality, Max has $7,500 of non-deductible money across his IRAs and $93,000 of pre-tax money. In other words, 7% of the funds in Max’s IRAs are non-deductible, and the other 93% of the funds are pre-tax. So, of the $7,500 Roth conversion 7% is tax-free; the other 93% is taxable at ordinary income rates!

You may be saying to yourself, “I have pre-tax money in IRAs, does this mean that I cannot utilize the Backdoor Roth IRA contribution strategy without incurring negative tax consequences?" For many of our clients with a current 401(k) plan, the answer is you can utilize the strategy, with some preliminary clean-up.

At Willis Johnson & Associates, many of our clients are energy executives and professionals who are still working in corporate America and have a 401(k) plan with their employer. Employer plans are not considered part of the pro-rata rule. Typically, it can be beneficial to consolidate accounts before applying the Backdoor Roth IRA Contribution strategy to your financial plan to help reduce potential tax impact.

So, if Max were our client, we may decide to consolidate his pre-tax IRAs to his company’s 401(k) plan. After we consolidated the $93,000 of pre-tax money into Max's company’s 401(k), then we could assist him in making a Backdoor Roth IRA Contribution because he no longer has any pre-tax IRA money.

When considering your financial goals and the strategies it takes to reach them, the backdoor Roth strategy can be highly beneficial for high-income earners to take advantage of. Discussing the backdoor Roth strategy with a financial professional early is important to take advantage of the compounded growth and future tax savings it offers. To better understand how you could leverage the backdoor Roth IRA in your financial plan, get in touch with one of our advisors who can offer guidance and additional recommendations to help you achieve your financial goals.