The BP Retirement Accumulation Plan ("RAP") pension is a significant benefit for BP employees. When a BP employee is leaving the company, there are many decisions to make – decisions about your 401(k), healthcare and other benefits, and decisions about your pension. In many cases, you do not need to decide about your pension benefit immediately upon leaving. Current law does not require you to take distributions from the pension until age 72. However, your decision's timing could be a significant factor in reaping the most from your benefit and the most suitable benefit for you.

BP Pension: Lump Sum or Annuity Payout

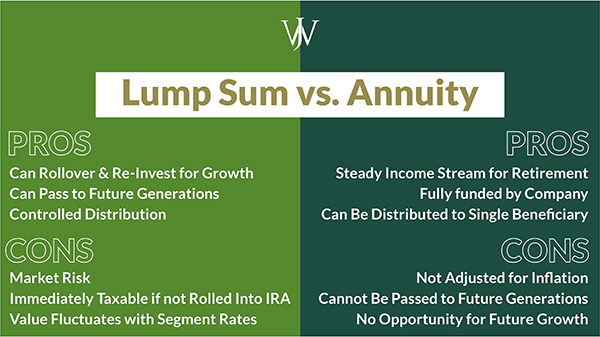

BP contributes and credits interest towards your pension account's cash balance during your time with the company, which comprises your pension's total. When you leave the company, you have a choice between taking the pension as a lump sum cash amount or a regular annuity – a monthly payment for the remainder of your life (and the life of your beneficiary).

Lump Sum Pension Considerations

Not all company pensions have a lump sum option like the BP RAP Pension. You can take the lump sum option in essentially two ways – cash out or in a rollover. If you simply “cash out," you will be subject to ordinary income tax and, if you are younger than 59½, a 10% early withdrawal penalty. Most people who take the lump sum make a qualified rollover to either a personal IRA account or their 401(k) account to defer taxes on the distribution and continue growing the funds.

BP bases its lump sum amount on the cash balance amount in your pension account. Therefore, depending on your tenure with BP, the lump sum amount will be equal to or greater than the cash balance.

| How To Determine The Payable Amount For BP RAP Lump Sum |

||

| Participants hired |

Participants hired |

Participants rehired on or after 1/1/2014, but before 1/1/2016 who have maintained their participant benefit in the plan from before 1/1/2014 |

| The greater of the cash balance of your pension account or a calculation based on applicable interest rates |

The cash balance of your pension account |

The greater of the cash balance of your pension account or a calculation based on applicable interest rates |

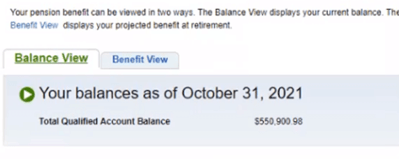

In your Fidelity NetBenefits portal, you can view the cash balance of your account by selecting the RAP Pension from the account menu and clicking on the “Balance View” tab on the pension summary page. Based on your tenure, as noted above, this may be your lump sum amount.

Lump Sum Pensions & Interest Rates

If you worked from BP before January 1, 2014, though, you likely have a lump sum based on interest rates; This is referred to as the "whipsaw calculation" by some BP veterans.

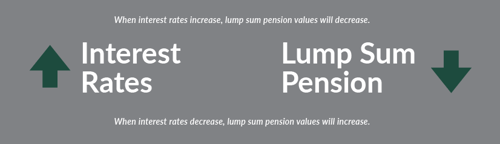

Interest rates have an inverse effect on the lump sum: The lower the prevailing interest rates, the higher the lump sum payout amount available.

Because interest rates have been meager in recent years, those who have recently elected BP lump sum distributions based on interest rates at retirement or severance have had significantly larger lump sums than their pension account cash balances. Learn more here >>

Which Interest Rates Does BP Use for Pension Calculations?

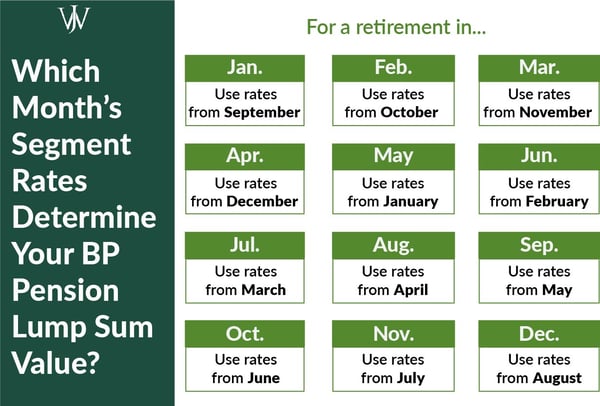

There are two categories of interest rates used to determine the lump sum pension payout. First, there are the monthly 30-year treasury rates (“30-yr TSR” published monthly by the IRS ) and segment rates (Minimum Present Value Segment Rates published monthly by the IRS). The applicable rates are those published for the month four months before the elected distribution date. For instance, the applicable rates for a January 2022 distribution would be the 30-yr TSR and Minimum Present Value Segment Rates published for September 2021. The IRS publishes segment rates around the 20th of the following month.

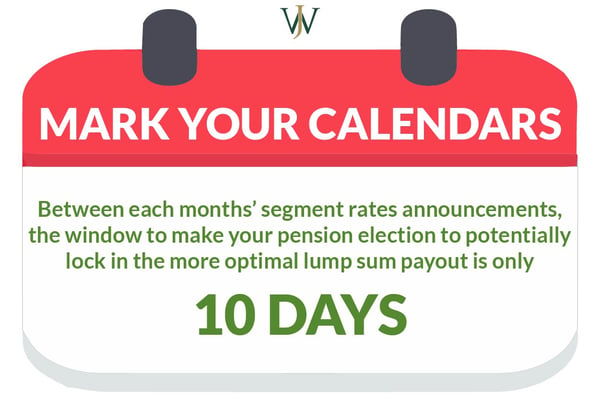

There can be a bit of a timing strategy around electing your distribution. You must make your pension distribution election 30 days before the distribution date in most circumstances. If you plan to elect a distribution effective January 1, for example, you must submit your election by December 1. As mentioned before, your January lump sum distribution would be based on September interest rates. What if you wanted to see if applicable interest rates drop in October, rendering a more significant lump sum amount for a February distribution? You will not have this data until the segment rates get published around November 20. If the rates in October rose, rendering a smaller lump sum for February, you would have ten days to lock in your September rate for a January distribution.

This is important to understand because while rates will generally rise in the coming months, economic factors ranging from the supply chain, employment, and the status of the pandemic could trigger occasional pullbacks along the way.

Annuity Pension Payout Considerations

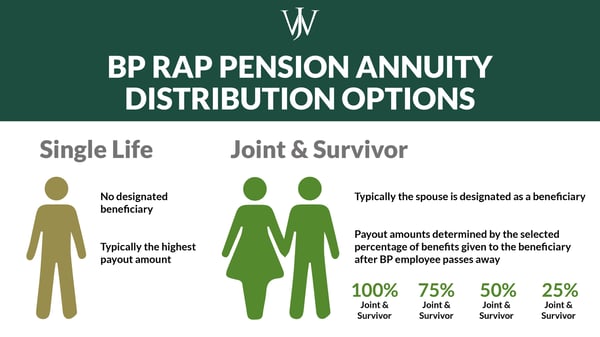

The annuity option under the BP RAP Pension is to receive a regular payment every month for the rest of your life and a beneficiary's life. BP employees can elect an annuity in a few ways. The annuity is an amount determined by your pension account cash balance, your age, your beneficiary's age, and the amount you elect to leave to your beneficiary.

Single Life Annuity

If you have no beneficiary or choose not to designate a beneficiary for your pension annuity, your Single Life annuity amount will be more significant.

Joint & Survivor Annuity

If you designate a beneficiary and elect to have the total pension amount paid to that beneficiary should you predecease them, your 100% Joint & Survivor annuity amount will be smaller. You can choose to have a 75% Joint & Survivor, 50% Joint & Survivor, or 25% Joint & Survivor annuity paid to your survivor. These options provide a larger benefit than the 100% Joint & Survivor while you are alive compared to the smaller benefit your surviving beneficiary would receive.

In most cases, the annuity option includes the employee’s spouse of a relatively similar age. Choosing a beneficiary such as a substantially younger child will significantly reduce your pension annuity amount.

Cons of an Annuity Pension Payout

So why would you not choose the regular annuity versus the lump sum? Typically, the biggest drawback to the annuity option is that what you are paid monthly does not change. This fixed payment means your annuity will become a smaller part of your retirement income with inflation over time.

Another drawback can be control — Once you and your beneficiary die, your pension lapses. Conversely, with the lump sum, you can pass the annuity on in a retirement account.

Choosing Both the Annuity and Lump Sum

You also have the option of electing both annuity and lump sum: 50% lump sum amount and 50% of your annuity. This option is only available to those who elect a single-life or 100% Joint Annuity.

One important note: If you are married and choose an annuity or lump sum option other than the 100% Joint & Survivor annuity, your spouse will have to make a sworn (notarized) waiver.

Not Making a Pension Distribution Election

As mentioned before, you do not have to make an election about your BP RAP pension until you reach the required distribution age of 72. Several financial advisors will overlook this and advise immediate rollover of the lump sum. However, there can be some benefits of deferring your pension election, and there can also be some costs in delaying. Here are some primary considerations:

If you became a BP employee before 1/1/2016

If you were a participant in the RAP pension before 2016, you have a guaranteed interest credit to your pension account of 5%. In the current low interest rate environment, this is an outstanding crediting rate. While the crediting rate can benefit your pension amount, deferring your election could mean that your lump sum pension is determined by higher interest rates and be tapered (if you were a participant before 2014). You could lose the effective benefit of the 5% crediting to a reduction in the lump sum calculation. Suppose you elect to defer taking the lump sum due to the 5% crediting. In that case, you should consider investing your other assets more aggressively since your pension is all effectively in fixed income.

If you became a BP employee on or after 1/1/2016.

If you became a participant in the RAP pension in 2016 or later, your interest crediting amount equals the 30-year treasury rate. The current prevailing rate is around 2%. It may not be beneficial to defer with such low crediting and instead reinvest your lump sum in your IRA or 401(k).

The future of the pension. The BP RAP pension is very well funded. As of January 1, 2021, the actuarial assessment of BP’s pension determined the Retirement Accumulation Plan had a funding ratio of 133%, meaning that BP adequately funds the pension plan to cover potential benefits for all participants at this time. However, BP has reduced pension benefits over time with the lump sum calculation and the account crediting. Also, the future crediting of the RAP pension relies highly on BP’s financial health. As such, there is no assurance in the relatively new BP Net Zero strategy or another single, impactful event like the Horizon accident.

Therefore, you may not have to decide about your pension, but you may want to ensure you receive the best benefit available to you. When the advisors at Willis Johnson & Associates work on the pension decisions of BP employees retiring or severing from the company, we analyze the full scope of options, present the pros and cons of such options, and develop a plan for the pension benefit that makes the most sense.

How to Make Your Personal Pension Decision

Beyond how the pension works for you based on your participation and tenure, there are infinite, personal considerations concerning the pension. Following are some considerations based loosely on some of the matters Willis Johnson & Associates Advisors have worked with our BP professional clients. If you’re—

Mid-Career, taking Severance: Lump Sum

If you are many years from retirement, your long time horizon allows you to invest your retirement funds in a manner that should provide you with better than a 5% return over the long run. Taking the lump sum, particularly if you benefit from the low interest rates, could be most beneficial.

Later Career and Taking Severance: Defer decision until retirement.

If you are severing from BP and plan to work a few more years, it may make sense to allow your pension account to remain in place with continued crediting. However, this only makes sense if you are a pre-2016 with the 5% minimum crediting and should be weighted with the lump sum available in the current interest rate environment. Ensure you watch the appropriate interest rates and be prepared to quickly initiate the pension lump sum if rates begin rising swiftly.

Worried about the markets: Annuity

If you are concerned about having all your investments in the market, then having some amount of your retirement income remain in the relatively stable pension can help manage the risk of your losing sleep.

Retiring with just enough, except for maybe inflation: Annuity or Lump Sum

If you have accrued a substantial amount in your BP ESP 401(k), BP RAP Pension, and other accounts for retirement, then either pension option may work for you. However, you should consider the effect of inflation-adjusted expenses in your calculation. The BP Pension annuity will always be the same and may not maintain your purchasing power.

Retiring with more than enough: Annuity

If every analysis shows that you have accrued more than enough for retirement, keeping part of your pension benefit inside the pension could be an exercise in healthy diversification.

Retiring, not married, and wanting some market safety: Single life annuity

Assuming you have enough to keep up with inflation, the single life annuity offers the largest of the annuity payouts and may offer the feeling of security as markets change.

Retiring, not married, and committed to charity: Lump sum

You would have the flexibility to leave the pension to any organization or individual upon your death.

Retiring early: Annuity or lump sum

If you plan to retire before you can tap into your retirement funds without penalty, then an annuity might make sense to cover your income needs. However, there are special elections that can avoid the early withdrawal penalties and make the lump sum more attractive.

These are examples of several personal factors that should be analyzed and considered along with the pension options available to you based on your service tenure with BP. In addition, there may be several personal factors which you need to consider.

Whether retiring or departing BP mid-career, you should carefully weigh the options available to you. You should also understand that, in most cases, there is no immediacy for a decision to be made when you depart. However, evaluating the decision is crucial because it is irrevocable once you put your choice in motion.

Expertise in financial planning and BP benefits can help you in all of this evaluation and planning. Willis Johnson & Associates’ advisors are knowledgeable about BP benefits and how they can work together. We help BP employees and retirees clarify their goals and resources, evaluate and educate them on the best opportunities for meeting those goals, and implement and maintain the strategies to achieve those objectives. We are a fiduciary and work in your best interest.

Your BP RAP pension benefit is a significant component of your retirement planning and deserves careful and committed examination in making the election. Please call WJA for a complimentary consultation.