If you are considering leaving BP soon, you need to consider how interest rates may affect your plans.

The BP pension, "The Retirement Accumulation Plan" ("RAP"), is a valuable benefit, but how you use it may vary widely on the prevalent interest rate environment. We have seen a significant rise in interest rates since the beginning of 2022. This may shift what we at Willis Johnson & Associates see as the preferred strategy for exercising your benefit under the RAP going forward.

Funding for the RAP

The RAP is an employer-funded retirement-defined benefit plan. It is a unique benefit as only about 15% of U.S. private sector employees have such a benefit option.

Pay Crediting

More specifically, the RAP pension is a cash balance plan. Each participant has a funded account. BP funds the accounts based on pay credits structured around each participant's age and years of service to the Company, as shown below.

|

Pay Credit Formula |

Credits as a percentage of Your Eligible Earnings (up to ¼ of the Social Security Wage Base) |

Credits as a percentage of Your Eligible Earnings (above ¼ of the Social Security Wage Base) | ||

|

Years of Vesting Service |

Age |

|||

| Under 10 | and | Under 40 | 4% | 7% |

| 10, but less than 20 | or | 40, but less than 50 | 5% | 9% |

| 20 or more | or | 50 or more | 6% |

11% |

Let's consider an example. Candace is 45 years old and has worked for BP for nine years. Her salary and bonus amount to $200,000. The social security wage base (the amount that is taxed for social security) for 2023 is $160,200. Therefore, Candace will receive pay credits as follows.

5% of ¼ of $160,200 ($40,050) = $ 2,002

9% of $39,800 ($200,000 less $40,050) =$14,395

Total Pay Credits for Candace for 2023: $16,397

Candace has fewer than ten years of service. Therefore, she received crediting based on her age.

The pay credits are annualized and paid on a monthly basis based on monthly compensation. As a result, additional pay credit is usually applied to the pension account in the month of the bonus.

Interest Crediting

In addition to the pay credit, the accounts receive a monthly interest credit. The interest credit paid is based on the current 30-year treasury rate and a certain minimum interest rate based on when the participant has dollars in the plan.

| Beginning Participation in the Plan | Interest Credit |

| Before January 1, 2016 | 30-year treasury or a minimum of 5% |

| January 1, 2016, and after | 30-year treasury or a minimum of 2% |

Let's consider another example to see how this accrues. Don started at BP in 2012, and Joanne started at BP in 2017. The current 3-year treasury rate is 3.75%. Don will receive crediting of 5%, the minimum interest crediting, because he was a pension participant prior to 2016. Joanne will receive 3.75% interest crediting, the 30-year treasury amount, because she became a participant in the RAP pension after January 1, 2016.

It should be noted that years of vesting service for ex-patriots who have worked for BP overseas can vary by the individual employment agreement. However, non-U.S. service can be ascribed for calculating the pay credits. However, years of service do not affect the interest credit.

Let's consider one more example using an ex-pat named Nigel. He's 48, and he joined BP in the U.K. when he was 23. He transferred with his group to the U.S. and became "patriated" under the U.S. benefit plans in 2018. As a result, Nigel will receive pay credits commensurate with his having over 20 years of service with the Company (6% of ¼ of the social security wage base and 11% of wages above the ¼ of the social security wage base). However, Nigel will only be guaranteed a minimum 2% interest credit because he did not have funds in the RAP pension until after January 1, 2016.

Interest Rates & The BP Pension Calculation

In the interest crediting above, we can see one-factor interest rates have. For example, when the 30-year treasury rate hovered around 1.3% during the beginning of the COVID-19 crisis in 2020, all RAP pension participants received either 2% interest crediting or 5% interest crediting based on their pension initiation date.

The low-interest rates were a much more significant factor in planning for the benefit because of the effect on the lump sum calculation. Therefore, for those participants who initiated their RAP pension benefit prior to January 1, 2014, a calculation of their eligible lump was made with the prevailing interest rates – more particularly, the segment rates representing the short-, medium-, and long-term rates of the corporate bond yield curve. The rates are published by the IRS monthly.

BP uses the rates from four months before the elected lump sum distribution to determine the lump sum amount.

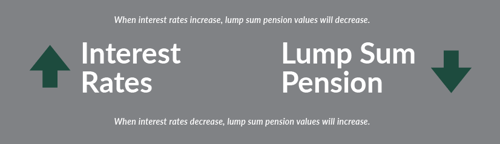

When interest rates are low, as during the pandemic, the lump sum amount can increase based on a calculation applying those interest rates. But conversely, as interest rates rise, the lump sum amount will decrease.

This interest rate effect on the lump sum pension distribution is sometimes called the "whipsaw calculation."

As a basic example, consider the following scenario:

- You have a $1,000,000 cash balance in your pension account.

- You have a life expectancy of 22.9 years[2]. The Lump sum calculation is generated on a benefit beginning at age 65

- That renders an estimated annuity of around $6,200 per month

Take this same cash balance example; we apply it to compare different segment rate environments at the time of retirement and see the results.

| Scenario 1: Retiring when interest rates are very low (similar to 2021) |

Approximate Lump Sum $1.262 Million (Based on segment rates) |

|||

| Segment 1 | Segment 2 | Segment 3 | ||

| Low Rates | 0.70% | 2.55% | 3.06% | |

| Scenario 2: Retiring when interest rates are more elevated (similar to 2023 or years past) |

Approximate Lump Sum $1Million |

|||

| Segment 1 | Segment 2 | Segment 3 | ||

| Elevated Rates | 3.71% | 5.05% | 5.42% | |

Here is the crucial thing to note in these calculations. In scenario 2, if you apply the elevated segment rates in the example, the actual calculated amount is less than $1 million. However, no matter how high rates climb, you will never get less than your cash balance as a lump sum distribution.

This is a vital consideration because if you have an augmented lump sum with lower interest rates, there is a strong advantage to taking the lump sum immediately. However, if the cash balance is not augmented, the 5% pension crediting can be very attractive, and you may wish to defer your distribution election.

You do not have to take the pension immediately, and you can continue receiving the 5% interest credit.

That is why understanding your pension interest crediting is essential.

Financial Planning Strategies & Decisions To Consider Regarding the RAP Pension

There are several things to consider in making the pension election.

Annuity v. Lump Sum

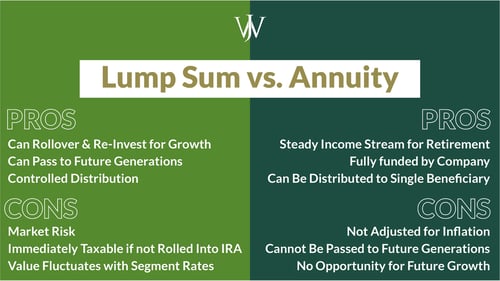

First, consider whether you want to take an annuity payment stream or a lump sum. You can take the pension completely as an annuity with regular payments. You can take the pension entirely as a lump sum. Or you can take part of the pension as an annuity and part as a lump sum.

We generally favor our clients taking the lump sum for two key reasons.

- Inflation. The annuity amount you receive in the annuity stream will always be the same. It will not increase. By taking the lump sum and re-investing it in your IRA or 401(k), your pension benefit can keep pace with inflation.

- You can pass on the benefit. Once you and your spouse pass away, there is no longer a benefit if you take the annuity. In contrast, if you take a sum, you have the benefit as a fully owned asset to pass on to children, grandchildren, charity, or whomever.

We recognize that there are other factors to consider in determining whether to take a lump sum or annuity.

- The amount you have on which to retire.

- The amount you need in retirement

- Your investment risk tolerance

- Whether you desire to leave your pension to somebody

Working with a financial planner like the advisors at Willis Johnson & Associates can help analyze and weigh all the factors without putting pressure on you to roll over the pension, so it can become an asset for the advisors to manage.

It would help if you planned with your RAP pension in mind, which can be a reason to defer taking the pension.

Asset Allocation: Using the RAP Pension as Fixed Income

Most people consider the stable part of a portfolio to include bonds. This is because bonds have less volatility than the stock market over time.

A stable "fixed income" portion of a retirement portfolio can provide a cash flow for living expenses and maintain portfolio value throughout all market and economic conditions.

The cash balance RAP Pension is a stable part of your retirement portfolio.

- The cash balance does not lose value

- It has a guaranteed interest rate.

Recognizing the RAP as a fixed income part of your greater allocation is prudent because it can determine how you allocate your investable assets. For example, you can invest more in less stable, higher-growth stocks because you have the RAP pension.

Let's consider a BP employee, Emma, who wants to keep a 70% stock/30% fixed income allocation in her portfolio.

Her BP ESP 401(k) has a $2 million balance, and it is allocated 80% stock/ 20% fixed income. Her brokerage account has a $1 million balance, and it is allocated 50% stock/50% fixed income. Therefore, she is maintaining her desired allocation across the $3 million in the two accounts. However, Emma also has a $1 million cash balance in her BP RAP pension.

If she includes her pension in the allocation, Emma has a 52.5%/47.5% allocation across the $4 million of her accounts - far more weighted to fixed income than Emma desires.

If Emma were to invest her BP ESP in 100% stock, she would have the 70%/30% allocation she desires.

You do not have to take your lump sum pension right away. You can defer it until you reach the minimum distribution age. Having the benefit of a very regular part in your investment allocation planning can be one reason to defer taking your RAP benefit. Also, for whatever reason you defer your RAP pension benefit, you should consider it as part of your allocation.

Deferring the RAP for savings strategies.

In the years following your retirement from BP, you may continue to receive income – severance payouts and Share Value Plan vesting, for example. You may even commence a new work assignment with another company or independently. This additional income allows for some additional savings.

One of the critical savings strategies we implement is the Backdoor Roth– making after-tax contributions to a traditional IRA and converting the contribution to a Roth IRA. To execute this strategy effectively, you cannot have any existing pre-tax assets in an IRA account. If you were to roll over your RAP Lump sum benefit to an IRA, this would defeat this strategy.

How a Fiduciary Financial Planner Can Help You Secure More for Your Future

At Willis Johnson & Associates, we recognize the value of the BP RAP Pension crediting. Many advisors focus on how segment rates affect the lump sum with the goal of performing an immediate rollover of the lump sum benefit to an IRA they can manage. Instead, we focus on what is best for you.

Because WJA is a fee-only firm and does not receive commissions or compensation from the financial solutions it offers, we are considered a fiduciary – serving our client's best interests. Only 12% of financial firms, including WJA, are considered fiduciaries or RIA-only firms.

However, WJA takes being a fiduciary to a higher level. We advise our clients to defer pension elections when it is in our client's best interest to do so. We also segregate certain investments instead of immediately divesting and bringing the assets under our management when it is in the client's best interest to do so. For us, planning and initiating a strategy is dictated by what is best suited to you - your financial future and your goals.

We look forward to discussing and evaluating your financial future and your goals. Please contact us to schedule a complimentary session to discuss your benefits, tax situation, investment portfolio, family's needs, and objectives.