Jingle bells, bright colors, twinkling lights, and the acclaimed Mariah Carey song hitting radio stations nationally all signify that the year is coming to a close. Often in December, we see Chevron professionals shift their focus towards family and time away from the office, missing out on their limited window to use opportunities to lower their tax bill and get additional savings for retirement. Before this year ends, Chevron employees can take advantage of the opportunities uniquely available to them in their Employee Savings Investment Plan (ESIP), Chevron’s Humankind Program, and their health plan options as a final push to make the most of their financial planning for 2025. Curious how much you can lower your tax bill with these strategies? Let’s review.

Max Out Your Chevron 401(k), the Employee Savings Investment Plan (ESIP)

The Employee Savings Investment Plan (ESIP) is the name for Chevron’s 401(k) plan. Chevron will contribute to your ESIP by matching your contributions up to 8% of your salary annually. Chevron will not contribute on your behalf if you don’t contribute to your ESIP.

401(K) Contribution Limits for 2025

If you are under 50, in 2025, the total IRS limit for your 401(k) contributions is $70,000. If Chevron contributes the full $28,000, employees under 50 can contribute $42,000 across the Pre-Tax, Roth, or After-Tax sources. However, if you are over 50 in 2025, there’s a catch-up contribution allowed in the 401(k). For individuals age 50 and over, the 2025 total IRS limit for 401(k) contributions as an employee is $77,500. If Chevron contributes the full $28,000, employees age 50 and older can contribute $49,500 across the Pre-Tax, Roth, or After-Tax sources.

Are you on track to max out all of the sources available in your ESIP for 2025?

Find out here >>

As a Chevron employee, knowing your specific 401(k) contribution limits for 2025 helps ensure you're maximizing all of the sources available in your ESIP. However, we rarely see Chevron employees get their 401(k) fully maxed out because it requires so much ongoing maintenance.

Advisor tip: The Chevron 401(k) is not a set it and forget it 401(k) plan.

The best way to check if you are on track to maximizing your ESIP is to pull a year-to-date statement several times throughout the year. To see if you’ve maxed out the ESIP, use the following steps to pull up your contribution summary.

- Log in to your Fidelity NetBenefits account

- Select Your Employee Savings Investment Plan 401(k) account

.png?width=450&height=188&name=EOY_Blog_2024_12_600x25_Graphics%203%20(3).png)

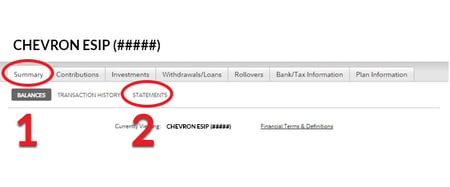

- Under the “Summary” tab, select “Statements”

- Choose Year to Date to see this year’s data (or use the specific date feature to look at previous years), and click “Retrieve Statement”

.png?width=300&height=250&name=EOY_Blog_2024_12_800x450_Graphic%202%20(1).png)

- Scroll down to “Your Contribution Summary” and review your contributions.

Often, we see many Chevron professionals’ contribution summaries look something like this if they believe they’ve maxed out the 401(k) for their age and their income meets the IRS 415 income limitations in a given year.

Not on Track for Maxing Out the 401(k)? Consider this.

If you are not on track to max out each source, your only option is to increase your election amounts to compensate for the shortfall. Just as important, it would be a good idea to plan your contribution amounts for 2025 to ensure you maximize your benefits. In 2023, when the IRS released its annual contribution limits, it was the largest increase in history due to recent inflation. Therefore, proper planning is critical to ensure you are not leaving money on the table going into 2025 since these numbers change every year.

Discover How To Max Out Your 401(k) Before the End of 2025 Here >>

Leverage the Backdoor Roth Strategy for Tax-Efficient Savings

A backdoor Roth strategy allows you to bypass the IRS' income limitations on Roth contributions to save an additional $7,000 in 2025 ($8,000 if over age 50) above what you're saving in your 401(k) using the pre-tax, Roth, or after-tax sources.

To do a backdoor Roth, you make a non-deductible after-tax contribution from your bank account to an IRA. Once funds are in the IRA, the backdoor Roth strategy allows you to roll over the funds to a Roth where they can grow tax-free for life, as long as your IRA had no pre-tax funds.

Watch Out for the Pro-Rata Rule

If you have pre-tax money in an IRA when you convert to a Roth, you will trigger a taxable event. “Cleaning up” your IRA is important before starting the strategy to avoid any taxes on the Roth conversion for pre-tax funds, which are taxed as ordinary income. Especially if you’re in a high tax bracket, this conversion can be costly, so cleaning up the IRA is essential.

The deadline for making back-door Roth contributions is April 15th, 2026; however, the deadline to “clean up” your IRA to avoid paying taxes on the back-door Roth contribution is year-end.

How to Clean Up Your IRA

Cleaning up your IRA can seem complex, so let's break it down.

- Roll over the balance of your IRA into your ESIP. For Chevron employees, this is often called a “reverse rollover."

- Perform the backdoor Roth after the reverse rollover, which doesn’t trigger taxes on the conversion.

The deadline to perform the reverse rollover to avoid paying taxes on your backdoor Roth contribution is December 31st, 2025, so act fast!

Minimize Taxes Through Charitable Giving in Chevron’s Humankind Program

For many Chevron employees, 2024 was a high-income year, which means your tax bill in 2025 may be higher than normal! Luckily, by using the Chevron Humankind Program, reducing your taxes and donating to the foundations and causes you care about most go hand in hand.

Did you know that through the Chevron Humankind program, Chevron provides a company match to their charitably-inclined employees and retirees? This program matches charitable donations from Chevron employees up to $10,000 annually and up to $3,000 annually for Chevron retirees. With this program, giving this holiday season can make more of an impact than you think.

In order to be eligible for a corporate match in the Chevron Humankind program, the organization receiving donations from a Chevron employee or retiree must be a 501(c)(3) organization.

Keep in mind: The deadline to make a charitable matching gift is 12/31/2025

Offset Investment Losses Through Tax Loss Harvesting

A great way Chevron employees can save money in taxes is by selling an investment that is trading at a loss inside a non-retirement account. This strategy is better known as Tax Loss Harvesting.

Tax loss harvesting occurs when you sell an investment trading at a loss and use that loss to reduce your realized capital gains or offset up to $3,000 of ordinary income. Finally, with this strategy, you can reinvest the proceeds from the sale into a different security. While the strategy is pretty straightforward in theory, it has several pitfalls if done improperly.

The first pitfall of tax loss harvesting is that it does not work with retirement accounts. Tax loss harvesting is not a viable strategy in an IRA, 401(k), or Roth, because you cannot deduct losses inside a tax-deferred account. Only brokerage accounts are eligible.

The second and most common pitfall is the “Wash Sales Rule.” This rule states that if you sell a security at a loss and buy the same or a "substantially identical" security within 30 days before or after the sale, the loss is typically disallowed for current income tax purposes.

Tax loss harvesting is a great way to save money in taxes, especially in a volatile year like 2024. Let’s look at an example to quantify the savings.

Suppose April is in the 32% marginal tax bracket for 2024. She decided to sell poorly performing investments and use the $3,000 of losses to offset her ordinary income.

|

|

Do Nothing |

Tax Loss Harvest |

|

Total Compensation (Base + CIP)

|

$455,000

|

$455,000

|

|

ESIP Contribution

|

-$28,000

|

-$28,000

|

|

Interest / Dividends

|

$5,000

|

$5,000

|

|

Gains/Losses

|

$0

|

-$3,000

|

|

Standard Deduction

|

-$30,000

|

-$30,000

|

|

Taxable Income

|

$402,000

|

$399,000

|

|

Total Tax Due

|

$84,013

|

$83,053

|

By utilizing this strategy, April saves about $960 in taxes this year! When coupled with additional strategies like charitable giving and retirement savings contributions each year, those tax savings increase substantially over time!

Max Out Chevron's Health Savings Plans

Health Savings Account or the Flexible Spending Account

Another opportunity available to Chevron professionals is saving in the company's various health accounts for paying medical expenses – The HSA or the FSA.

A Health Savings Account is unique because its funds roll over from one year to the next. It is not a use-it-or-lose-it account, so there is no rush to spend it all. In fact, once you reach certain thresholds of savings, you can invest those funds for triple-tax-advantaged savings. But, to make the most of these plans, you do have to ensure you are on track to max it out each year.

For 2025, the contribution limits are:

- $4,300 for self-only contributions,

- $8,550 for family contributions, and

- $1,000 for catch-up contributions if you are age 55 and up.

It is important to note that the catch-up is per eligible individual under your plan. Therefore, if you and your spouse are over 55, you can each make a $1,000 catch-up towards a family HSA, totaling $10,550 in 2025!

In addition to these contributions, Chevron contributes a company match based on plan type. Chevron contributes up to $500 for self-only plans and up to $1,000 for a family plan.

With Chevron’s matching contributions, the maximum a Chevron employee can contribute in 2025 to their HSA is as follows:

- For a self-only plan: $3,800 ($4,300 - $500 Chevron match)

- For a family plan: $7,550 ($8,550 - $1,000 Chevron match)

- For those ages 55 or over, you can contribute an additional $1,000 to either plan.

To confirm if you are on track to max out your HSA contributions, pull up your most recent pay stub and compare your year-to-date HSA contributions to the limits above.

Keep in mind, Chevron does not monitor your contributions. You are responsible for tracking total contributions from all sources (payroll contributions and company match). If you overcontribute to your HSA, you may be subject to taxes and penalties, so it is important to monitor your contributions carefully!

Flexible Spending Account – Use it or Lose it

In contrast to your HSA, the Health Care Spending Account or Flexible Spending Account (FSA) is typically a use-it-or-lose-it account. Each year, you must use the entire balance of the account, or any contributions will be forfeited. Therefore, it is imperative to plan your contributions accordingly, so you don't leave money on the table.

A common mistake we see Chevron professionals make with this type of account is overcontributing to the FSA and underspending it. Unlike a typical savings account, you can only use the funds in your FSA for certain qualifying medical expenses in a given year. We often recommend that employees contribute enough to the FSA annually to cover out-of-pocket costs to avoid forfeiting used amounts while still receiving the tax deduction associated with FSA contributions.

Important note: Expenses incurred from January 1 to December 31st, 2024, must be submitted for reimbursement to HealthEquity by June 30th, 2025. Any remaining balances that haven't been reimbursed after June 30th are forfeited.

Decide Whether to Exercise or Defer Exercising Your Stock Options

Due to their complexity, many Chevron employees come to us with questions about their Non-Qualified Stock Options (NQSO). These stock option grants are awarded in January and vest on a prorated basis over the following three years.

Non-Qualified Stock Options are taxed at exercise and at the time of the sale, but differently at each milestone.

When you exercise the options, the monetary difference between the market value and the exercise price is subject to ordinary income + FICA taxes. The difference between the market value at the time of sale and the market value at the time of exercise is subject to short- or long-term capital gains depending on how long you’ve held the stocks after exercising them.

For Chevron employees receiving an NQSO vest in January 2025, the spread between the market value and exercise price could be significant, given Chevron’s phenomenal year of earnings and your grant price. Before exercising, it is important to consider the tradeoffs between exercising immediately or deferring.

Deferring Exercise to a Lower Income Year

Sometimes we advise Chevron employees to consider waiting to exercise their options in a lower-income year when it makes sense from a tax perspective.

Let’s say, for example, it is December 2025, and April has not yet exercised her vested portion of her 2024 NQSO grant, which is about 500 shares. At an exercise price of $90/share and a current market value of $185, the taxable portion of her vested shares is $47,500 ($185-$90 * 500). With a 32% marginal tax bracket, the after-tax value of her options is $32,300.

|

Market Value at Exercise

|

$185

|

|

Exercise Price

|

$90

|

|

# Shares Vested

|

500

|

|

Tax Bracket

|

32%

|

|

Gross Proceeds

|

$47,500

|

|

Taxes Due

|

$15,200

|

|

Net Proceeds

|

$32,300

|

Now let’s assume April is planning on retiring in January of 2026. Besides one month of income, she is expecting a CIP payment in March and no additional income for 2026. Therefore, her projected marginal tax bracket is 12%. If April chooses to defer exercising her option in December and exercise in January, the after-tax proceeds would be $41,800.

|

Market Value at Exercise

|

$185

|

|

Exercise Price

|

$90

|

|

# Shares Vested

|

500

|

|

Tax Bracket

|

12%

|

|

Gross Proceeds

|

$47,500

|

|

Taxes Due

|

$5,700

|

|

Net Proceeds

|

$41,800

|

By just waiting 30 days to exercise her stock options, she’s gained an additional $9,500 in value!

Give Yourself the Gift of Great Financial Planning

Don’t Leave Money on the Table for 2025

Conventional wisdom cautions investors not to let their tax worries in the short-term drive their long-term big-picture financial strategy.

To illustrate this, let's continue the example above. Let's say it is January 2025, and April plans to retire in January 2026. She expects to be in the 22% tax bracket in retirement.

All else equal, the tax savings from waiting one year to exercise is approximately $4,750. However, a lot could happen to the price of Chevron in one year. In fact, due to the implied leverage embedded in stock options, a 5% drop in Chevron's stock price would erode the tax arbitrage opportunity entirely.

Ignoring the tax implications when making investment decisions is not wise. However, considering your entire financial picture, it may make sense to pay the tax when a good investment opportunity presents itself.

You can consider many factors when evaluating charitable giving and retirement savings options, and your priorities can change yearly. However, this list only highlights a few financial planning considerations we discuss with our Chevron clients yearly. At Willis Johnson & Associates, we help our Chevron clients with their complex benefits and tax planning needs through our all-encompassing approach to financial planning. Before updating your out-of-office message this holiday season, consider starting the conversation with an advisor today who can help your family on the road to financial independence.