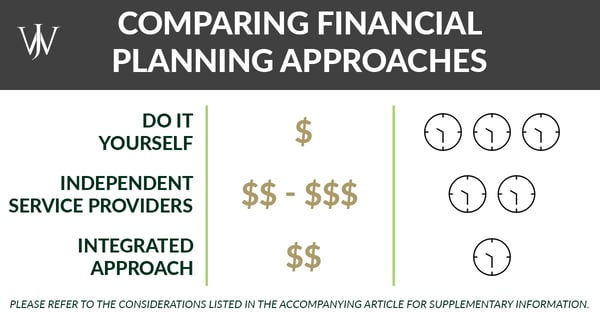

With the rise of robo-advisors and digital financial planning options, it’s becoming easier than ever to take a do-it-yourself approach to manage your finances; however, for many oil and gas executives, the nuances surrounding their money management require structure and expertise to avoid overpaying taxes or causing significant financial mishaps. Whether you choose to partner with an integrated wealth management firm like ours or handle everything yourself, it’s important to understand the time, cost, and value of these options, which is what we’re diving into today.

What are the Benefits of Hiring a Financial Advisor Instead of Doing it Yourself?

What we often see in our industry is that most people want to exercise full control over their money, which is what often pulls them towards the D-I-Y approach to money management. While this approach works well for simple financial situations, as your assets accumulate and your financial situation becomes more nuanced, the need for specialized tax and financial expertise grows. Working with a financial professional can help ensure that you're not missing out on significant opportunities to accumulate wealth or inadvertently overpaying on taxes.

Expert Guidance To Help You Through Financial Complexities

When taking on the burden of this financial responsibility, it falls on the individual to keep up with the latest tax forms and rules, financial legislation, and strategies to achieve the financial success they’re looking for. While this approach offers an individual full authority over their investment allocation and withdrawals, it can also open them up to unnecessary risk, missed opportunities, mistakes, or unconscious biases in decision-making that can have significant impacts on their long-term wealth.

Learn How to Avoid the 3 Costly Tax Mistakes We See ALL the Time Here

One of the biggest pitfalls we see from those choosing to handle their own finances is emotional decision-making. When the stock market makes major moves, the typical investor makes one or two poorly timed decisions that have significant impacts on their overall portfolio. In fact, the average investor only yields close to 2% returns over a 20-year period. Why? The typical investor is inundated with investment advice from numerous sources, alongside their day jobs, family and social groups, and more. With so much information and financial pressure, it’s difficult to be fully objective when it comes to effectively managing a portfolio.

What Can a Financial Team Offer You?

-

- Education & Objectivity

By contrast, working with experts such as CPA-certified accountants, Certified Financial Planners (CFP), or Chartered Financial Analysts (CFA) can offer an objective and educated opinion to help investors reach their long-term financial goals. For many of these designations, individuals must meet stringent professional and ethical requirements while obtaining a certain number of continued education hours each year to maintain their credentials. In doing so, these professionals upkeep the high standards of their credentials to become experts in their respective arenas and offer value to their clients. - Expertise & Protection

If you aren’t financially savvy or an expert on financial planning, you’re likely missing out on opportunities for wealth building. For larger estates & asset sizes, efficient financial planning can become extremely complex. While the old adage says, “more money, more problems,” we believe that it could also be amended to say “more money, more opportunities for problems to reoccur.”

When a family’s assets begin encroaching on the $1 million mark, the potential for numerous tax forms, investment fees, legal or insurance needs, and savings opportunities compounds in-kind, and often on a recurring annual basis. Inefficiencies of these sorts may not appear to cost anything upfront, but, it’s important to realize that the potential long-term costs (overpaid taxes, investment fees, missed wealth opportunities, incorrect insurance coverage, inefficient benefit elections, etc.) can be substantial over time and these unforeseen costs can oftentimes be minimized by working alongside financial experts. - Peace of Mind & Time

Lastly, effective financial planning is a continual process. Setting up a one-time financial plan typically won't work long-term as financial situations can change quickly and require immediate action. Whether you’re researching the latest tax legislation, comparing investment funds, or you’re compiling your statements from various bank cards and asset brokers, creating a financial plan that will help you achieve long-term wealth requires a significant investment of both your time and energy. Utilizing a financial planning team who can stay on top of a constantly-evolving plan lets you focus on the big picture and continue living your life while a group of experts handle the minutiae as changes arise.

- Education & Objectivity

What Are the Costs for Having A Financial Advisor?

Due to the complexity of individual financial situations and varying costs of services across locations, years of expertise, and depth of service offerings, it can be difficult to assess the true costs and value of financial planning as an individual compared against partnering with a team of experts. However, rather than including hard numbers, we think the value is best illustrated through use of a simple example.

Consider this:

If You're Managing Your Family's Finances Yourself:

As a savvy investor, you perform a backdoor Roth conversion to take advantage of long-term tax-efficient savings though you can’t contribute to a Roth directly. If, when filing your tax returns, you unknowingly fail to include a Form 8606, you could be subject to paying twice the necessary tax amount due to a lack of cost basis reporting. For non-tax professionals or as a DIY investor, it’s easy to miss the forms or requirement updates coming from the IRS each year.

While, in this example, you've simply missed one tax form, this is only one of the many nuances involved in successful financial planning long-term. If you miss additional forms, perform conversions or tax-strategies ineffectively, or make a few poor investment decisions for multiple years, the associated costs can compound over time into significant amounts of lost wealth.

Let’s consider the same example when paired with financial expertise, both against independent and integrated services.

If You Hire Independent, Ad-Hoc Finanical Services:

You're the same savvy investor. You hire a money manager who performs a backdoor Roth conversion early this year before tax season comes to mind. As the respective tax season rolls around, you gather your tax documents to take to your CPA. While your CPA and advisor are both experts in their respective fields, they fail to communicate with one another about their respective strategies employed to help you maximize your returns. The backdoor Roth contribution gets missed in the CPA’s preparation of your taxes and yet again, form 8606 fails to be included. Additionally, during the preparation of the taxes, the CPA realizes that you had significant capital gains taxes due based on the investment choices advised by the money manager. The end result: While you have experts helping execute the strategies and paperwork you were unable to execute alone, the financial planning is still inefficient and you've missed out on opportunities for additional savings and wealth accumulation.

If You Partner with Integrated and Strategic Wealth Management

Lastly, let’s consider the same example if you worked with a comprehensive wealth management firm like Willis Johnson & Associates. With a CPA working alongside the financial advisor on your account, the backdoor Roth conversion is filed appropriately with the correct cost basis reflected on Form 8606. Additionally, throughout the year as the your advisor made adjustments to the investment strategies, the CPA on staff provides tax-savings recommendations to ensure that the investor’s returns aren’t lessened by their tax burden. Additionally, the CPA recommends tax-loss harvesting to use investment losses for tax savings that can compound over several years. In our opinion, this scenario results in less time, stress, and taxes for the investor, which creates an inherent value over the long-term.

Launch the Next Stage of Your Financial Journey

At Willis Johnson & Associates, we believe that discovering the best approach for your financial situation is a personal choice that takes your long-term goals, financial acumen, and investment philosophy into consideration. We highlighted a few of the major factors to consider before deciding on an approach that works best for your family, but there are plenty of others to consider as well. As a fiduciary, fee-only firm, you can trust that we're always working in your best interest instead of for commissions or product sales. Our commitment is to helping your family make the most of your resources at every stage of life. You can learn more about the services we offer here or contact our team for a complimentary first meeting to learn more about how we can help you achieve your financial goals.