Many executives believe that they're maxing out their 401(k) contributions year after year. However, due to the IRS' 2026 401(a)(17) limitation of $360,000 in income and the impact it has on both individual and company contributions to a 401(k), many of these corporate professionals unknowingly miss out on thousands of dollars in potential contributions.

What are the 401(k) Income Limits?

There is a fairly unknown rule known as the 401(a)(17) contribution limit that keeps many corporate professionals from fully maxing out pre-tax contributions to their 401(k). The 401(a)(17) rules set a maximum on how much of an employee's compensation can be used to determine an employer's contribution or match amount to the employee's 401(k) and many other types of retirement plans.

Specifically, the 401(a)(17) rules only allow super-savers in 2026 to receive 401(k) contributions from their employers with consideration up to the first $360,000 of income for a qualified retirement plan, like a 401(k). Once someone has made $360,000 during the year, an employer can no longer contribute on the employee's behalf to their company’s 401(k) plan.

To prevent accidental overfunding in the 401(k), the vast majority of large employers will immediately cut off all contributions to an employee's 401(k) upon reaching the annual limits. The IRS specifies that only the first $360,000 of an employee's income can be considered for salary deferral into 401(k) plans, which means that both company and employee deferrals are often prohibited once an employee reaches that threshold.

Learn more about how these contribution limits impact your:

In some instances, an employer's plan can specify that contributions to a qualified retirement plan (ex.401(k)) are halted once a participant's total compensation exceeds the annual limits, and will re-route contributions into a non-qualified retirement plan instead.

Exceptions to the 401(a)(17) limits

There are exceptions to the 401(a)(17) earnings limit rules whereby a company can allow its employees to consider income past $360,000 when making contributions to retirement plans. Few organizations actually permit these exceptions, as they regularly conflict with anti-discrimination testing, which causes bigger problems for the organization.

How Could The 401(k) Income Limits Affect You?

We started working with a new client who almost completely missed out on maxing out his 401(k) contributions for the year, despite thinking he was set up to max it — all due to the 401(a)(17) limitations.

This particular client was a high-income executive from one of Houston's leading oil companies aiming to max out his contribution to his company's 401(k). He had a long career with the company and was grossing over $600,000 annually between base pay and bonus.

It's important to note that the 401(a)(17) limits take total income into account, including any bonuses or commissions received in addition to a salary.

He knew that for the 2026 year, the maximum amount he could put into the 401(k) is $32,500, as he is over age 50, and that his company's 401(k) contribution of 10% would max out at $36,000 of additional contributions to his 401(k). Luckily for him, he visited us at the beginning of the year.

Originally, he took his maximum employee contribution amount and divided it by his expected benefit-eligible compensation (salary + expected bonus) to determine how much to contribute pre-tax from his paycheck.

| Maximum Employee 401(k) Contribution Amount |

Total Compensation | Pre-Tax Contribution Percentage of Income |

| $32,500 | $600,000 | 5% |

His assumption was that if he set his pre-tax contribution to his 401(k) to 5%, then he would max out by year-end; however, this would prove to be a crucial error. Why? Because after his bonus and salary reached the $360,000 limit, both he and his employer were prohibited from making additional contributions to his 401(k).

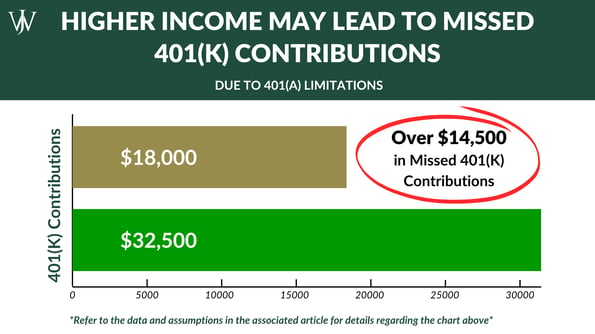

Since this saver set his contribution to 5%, he would have only contributed $18,000 ($360,000 * 5%) to his plan—potentially missing out on $14,500 of pre-tax contributions he could have made! After we sat down with him and showed him his 401(k) statement, he realized that due to the same error in prior years, he had missed out on thousands of dollars in tax-beneficial savings.

(For the 2026 year, the maximum pre-tax contribution for someone over age 50 is $32,500. This is $1,500 more than 2025’s maximum pre-tax contribution amount.)

Income Limits Affect Employer 401(K) Contributions

As mentioned above, the 401(a)(17) limits apply not only to employee contributions but also to employer contributions. Once you earn over the benefit-eligible contribution limit ($360,000 for the 2026 year), your employer is no longer able to put money into your 401(k). Many employers will set up non-qualified retirement plans so they can continue making contributions even if they cannot direct them to the 401(k), such as:

- Chevron ESIP 401(K) & ESIP-RP

At Chevron, the company continues to contribute the 8% but allocates the 8% for every dollar of income earned over and above the $360,000 limit to the ESIP Restoration Plan (ESIP-RP).

Learn more about maximizing savings for Chevron employees - Shell Provident Fund 401(K)& Provident Fund BRP

At Shell Oil, the organization continues its 10% contributions over the limit to the Provident Fund Benefit Restoration Plan (PF BRP).

Learn more about maximizing savings in the Provident Fund for Shell employees - BP ESP 401(K) & ECP

At BP, the company continues to contribute 7%, but defers them to another savings plan, the Excess Compensation Plan (ECP), with more stringent provisions.

Learn more about maximizing savings for BP employees

While the continuation of matching dollars is a nice benefit, these plans have additional limitations and restrictions, making them less attractive than the 401(k) plan. If you have a non-qualified plan, there are many considerations you should assess leading up to and before electing a retirement date to maximize your benefits and minimize taxes.

Make Sure You Get Your Maximum 401(k) Contributions in 2026

This super-saver could have easily made sure he maxed out his contribution to the 401(k) by slightly adjusting his formula. When determining his formula for 2026 contributions, he should take the 2026 max contribution limit of $32,500 and divide it by the 2026 income earnings limit of $360,000.

For 2026 contributions for those over 50, $32,500 / $360,000 = 9%

For 2026 contributions for those under 50, $24,500 / $360,000 = 7%

Both the maximum contribution and earnings limits are inflation-adjusted annually. Both limits utilize the same cost of living adjustment, so in most cases, the percentage deferral stays the same from year to year.

Generally speaking, if you are a high income earner and are subject to the 401(k) earned income limits, you will not be able to contribute to your 401(k) proportionally throughout the entire year.

How Income Limits Impact After-Tax and Roth Contributions

Also, note that all employee deferrals are affected by earnings limits. This includes Roth 401(k) contributions and Non-Roth After-Tax 401(k) contributions.

If you aim to max out both pre-tax and after-tax contributions to the 401(k), it’s important to max out contributions to the after-tax source before hitting the earnings limit. When doing the math, remember to take the maximum you can contribute to the after-tax source and divide by the earnings limits.

For example, our super-saver can contribute $11,500 to the after-tax source in 2026 using the assumptions from our earlier example. To make sure that he can max out contributions to the after-tax source in his 401(k), he will need to defer ~3% ( $11,500 / $360,000=3.19%) in addition to the pre-tax contribution before reaching the income limit.

Oftentimes, we see high earners make contributions to their 401(k) over the first half to three quarters of the year. Once they have hit the earnings limit, their net paycheck goes up as they can no longer make contributions to their company 401(k). It’s important to realize that if you are a high earner, you will have lumpy take-home pay, with lower earnings at the start of the year than at the end.

As part of our comprehensive asset management and planning process, we sit down with clients annually to review projected compensation and employee benefit plans, educating you on your options and assisting you in making the changes necessary to optimize your specific situation. At Willis Johnson & Associates, we work with our clients to help them get their company's full 401(k) contribution, max out their pre-tax and after-tax contributions, take advantage of backdoor Roth IRAs, and facilitate after-tax roll-outs from the 401(k) to get the maximum amount of savings. If you have any questions about the 2026 contribution and compensation limits, schedule a free consultation with one of our advisors.