Many of Shell’s high-income-earning executives don’t fully understand the differences between their numerous benefits, especially those related to their pension. Many who have spent their entire careers at Shell improperly manage the timing of their retirement, which impacts the calculation for their 80 Point Pension Benefit Restoration Plan. Poor retirement timing decisions often produce one of two results:

- The executive chooses a date that has significant tax consequences, or

- The executive chooses a payout date and elections that can save them hundreds of thousands of dollars—especially for those planning on retiring in the near term.

To learn how to avoid these costly mistakes and get the most from these two plans, let’s dive into the details and payout considerations so you can be fully equipped when the time comes to make your elections for each.

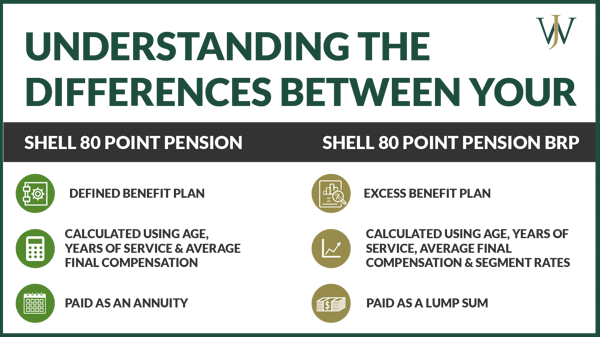

Understanding the Differences Between Your 80 Point Pension & the Pension’s Benefit Restoration Plan (BRP)

Shell 80 Point Pension

Many of our Shell clients are familiar with the 80 Point Pension the company offers. This defined benefit retirement plan uses your age, years of service, and average final compensation to determine a payout amount that Shell will pay you in your retirement. The Shell 80 Point Pension must pay out as an annuity.

Shell 80 Point Pension Benefit Restoration Plan (BRP)

If you are a highly compensated employee of Shell Oil and are on the Shell 80 Point Pension, Shell is likely making separate contributions to the Shell 80 Point Pension BRP on your behalf. The 80 Point Pension BRP is a non-qualified plan that allows Shell to restore benefits that an employee loses because of pension contribution limits set by the IRS each year.

Payout Differences Between the 80 Point Shell Pension & the Shell 80 Point Pension BRP

While your Shell 80 Point Pension must be taken as an annuity, your 80 Point Pension BRP is distributed as a lump sum. When you retire, Shell pays your 80 Point Pension BRP as a lump sum approximately 90 days after your retirement date (or six months if you are considered a key employee).

Learning how these benefits pay out upon retirement is a crucial step in retirement planning. Learn more here >>

How to Calculate the Shell 80 Point Pension Benefit Restoration Plan (BRP)

Most of our Shell clients do not realize that recent interest rates can impact the value of their employee benefits for retirement. Specifically, Shell uses the segment rates from September each year to calculate the Shell 80 Point Pension Benefit Restoration Plan (BRP).

To determine the value of the 80 Point Pension BRP lump sum, we need to calculate a summation of all future theoretical BRP annuity payments over the employee’s estimated life expectancy and discount it by the applicable interest rate (or in this case, the September segment rates). Thus, the lump sum value is simply the present value of future estimated monthly BRP annuity payments as a one-time summation. Here’s an example of this calculation:

When calculating the lump sum payout for the Shell 80 Point Pension Benefit Restoration Plan (BRP), Shell uses the September segment rates from the previous year. If you receive a pension BRP payout at any time in 2024, Shell uses the September rates from 2023, and if you receive a pension BRP payout at any time in 2025, Shell will use the September rates from 2024.PV = (PMT1/(1+r)1) + PMT2/(1+r)2 … PMTN/(1+r)N

PV = Present Value or “Lump Sum Value” in today’s dollars

PMT = Projected annuitized payment amount

R = Rate of return or “Segment Rate”

N = Number of Years remaining in life expectancy

What are Segment Rates and How Do They Impact The Lump Sum Payout of the Shell 80 Point Pension BRP

Segment rates are rates provided by the IRS that companies use to determine specific payout amounts for employee deferred compensation plans. Segment rates are highly correlated to the movement of interest rates for short, medium, and long-term bonds respectively.

Rates dropped in the second half of 2024. In October 2023, short, medium, and long-term segment rates reached close to and above 6% before falling in 2024 in response to cooling inflation. Almost a year later, rates for September 2024 teetered closer to 5%. This shift in segment rates plays a significant role in Shell professionals' BRP lump sum calculation.

Discover Stock Market Trends & Economic Analysis in our Recent Stock Market Update Here >>

To illustrate the impact of the movement in these rates, we can look at the difference between 2023 and 2024 rates. For the past few years, we’ve been in a high-interest rate environment due to the inflation from government spending and stimulus in 2020. However, as the Fed has moderately cut rates, the segment rates for September 2024 are more attractive than we've seen in the months leading up to this point. Let's take a look

| Segment Rates Impacting a Shell 80 Point BRP Pension Lump Sum Payout | |||

| Month/Year | 1st Segment | 2nd Segment | 3rd Segment |

|

September |

5.58% | 5.66% | 5.56% |

|

September 2024 |

4.17% | 4.76% | 5.25% |

Note, lower interest rates mean a higher value for your Shell 80 Point BRP Pension lump sum.

So, how can changing your retirement date from November of one year to December of the same year affect your payout, given the movement in segment rates?

Differences in BRP Pension Payouts in 2024 vs 2025

Shell Lump Sum Pension BRP Payout Example for 2024 Pension Elections

Let’s consider an example of a Shell employee choosing to retire in November of 2024.

a) 60-year-old retiring November 1, 2024

b) Pension starting December 1, 2024

c) Average Final Compensation is $600,000

d) Thirty Years of Service with Shell

e) The value of both the traditional 80 Point Pension and Pension BRP is worth $24,000/month

f) Net benefits is showing a traditional 80 Point Pension of $11,000/month

g) Life Expectancy is 83.4 years

If we run the example with a November 1, 2024 retirement date and a pension start date of December 1, 2024, Shell will use the segment rates from September 2023. The September 2023 segment rates were 5.58%, 5.66%, and 5.56%. In this scenario, the value of the lump sum for a December 2024 pension BRP election is worth approximately $2,027,816

Shell Lump Sum Pension BRP Payout Example for 2025 Pension Elections

Let’s fast forward and assume you want to retire at year-end.

In September 2024, the Fed began dropping interest rates across each segment. The resulting segment rates were 4.17%,4.76%, and 5.25%. This decrease in segment rates greatly impacts the lump sum calculation even if no other factors change.

For this example, we’ll change the Shell employee’s retirement date to just one month later than in the previous example.

a) 60-year-old retiring December 1, 2024

b) Pension starting January 1, 2025

c) Average Final Compensation is $600,000

d) Thirty Years of Service with Shell

e) The value of both the traditional 80 Point Pension and Pension BRP is worth $24,000/month

f) Net benefits is showing a traditional 80 Point Pension of $11,000/month

g) Life Expectancy is 83.4 years

If we run the math on the above example using the September 2024 rates, then the value of the lump sum BRP Pension paid out on January 1, 2025, is worth around $2,252,377. That’s a difference of over $220,000!

Why the vast difference? Segment rates in September 2023 were approximately .75% - 1% higher in each segment than those in September 2024.

Let’s briefly walk through how the math works to perform a rough calculation of the estimated value of the BRP Pension lump sum.

Essentially, it comes down to the basic time value of money. First, we must calculate a summation of all future theoretical 80 Point Pension BRP annuity payments over the employee’s estimated life expectancy discounted by the applicable rate (segment rates). This calculation gives us a lump sum value equivalent to these theoretical annuity payments. Remember, the 80 Point Pension is taken as an annuity, but the 80 Point BRP Pension must be taken as a one-time lump sum payment.

PV = PMT1/(1+r)1 + PMT2/(1+r)2 … PMTN/(1+r)N.

PV = Present Value or “Lump Sum Value” in today’s dollars

PMT = Projected annuitized payment amount

R = Rate of return or “Segment Rate”

N = Number of Years remaining in life expectancy

For our example, an overly simplified version of this equation might look something like this:

$2,252,377 = (13,000)1 / (1+4.17)1 + (13,000)2 / (1+4.76)2 … (13,000)13.4 / (1+5.25)13.4

The subscripts reflect each year remaining in the individual’s life span, and the calculation is run per month in each year over the 13.4 years used to calculate the lump sum.

Remember, as interest rates go up, the pension value will decrease, and vice versa.

Looking forward, segment rates today are lower than in September of 2023, and we expect that they could continue to drop through the rest of 2024 and into 2025 if the Fed can get inflation to its desired threshold in the coming months. It’s essential for Shell professionals to keep an eye on these rates to make educated decisions about when to start their pension and receive BRP payouts without leaving money on the table.

Understanding the impact of appropriately timing your Pension BRP payout can significantly affect your retirement income. Still, there’s another dark horse to keep in mind when doing your financial planning around it – Taxes.

Tax Impact of Your 80 Point Pension Benefit Restoration Plan Payout

The Shell 80 Point Pension Benefit Restoration Plan is a non-qualified pension plan, meaning it does not receive the same preferential tax benefits as your qualified pension, the Shell 80 Point Pension.

The Shell Pension BRP is immediately taxed at distribution, which means the Shell 80 Point Pension BRP is paid out within 90 days of retirement and immediately taxed for most retirees. You cannot roll your pension BRP into your 401(k) or IRA. Additionally, you cannot elect to defer receiving proceeds from your Pension BRP over time (unless you have an Old Money contribution or made benefit elections before 2007).

Learn How You Could Save Over $50,000 in Taxes on Your BRP Payout>>

Who Can Benefit from This Shell 80-Point Pension BRP Strategy?

For Shell employees considering retiring within the next 18 to 24 months or those who can retire earlier, looking at segment rates to maximize your 80 Point Pension BRP payout can be a great strategy to utilize.

We help our Shell clients looking at retiring in the next couple of years to analyze today’s segment rates to make the best election decision for their situation. Don’t overreact if you are looking at retiring in two to five years or are concerned about how rising rates may affect your Pension BRP payout. The value of your pension will increase by working longer, and no one knows exactly how rates will change over time.

This strategy may not fit those taking voluntary severances as Shell may have requirements for their termination date, and the severance can also be worth a substantial amount.

Before you make any decision, we recommend you work with a fiduciary financial advisor and seek confirmation about your various pension benefits and choices from Shell HR. Numerous employees at Shell have varying pension rules due to acquisitions, obtaining U.S. citizenship, being on the APF pension plan instead of the 80 point, and additional factors. Therefore, it is best to confirm how your retirement date affects your pension before making any decisions. Of course, taxes, other financial assets, personal goals, and financial needs all come into play. That’s why we perform a comprehensive assessment with our clients instead of simply looking at one item.

If you have questions about your Shell benefits and want a second opinion, contact one of our advisors who specialize in helping Shell employees make the most of these retirement savings tools.