If you’re about 10 or 15 years from retirement, you may be wondering where you stand. In particular, is your saving on track and at a point that allows you to coast through the next few years on autopilot, or do you need to be more intentional about when and where you’re saving?

As a Shell employee, you have a number of valuable retirement savings vehicles available to you that you should use to your full advantage, regardless of whether you’re 35 or 65.

These resources are:

- The Shell Provident Fund 401(k)

- Backdoor Roth Conversions and Mega Backdoor Roth Conversions

- Qualified and non-qualified retirement income benefits through the Shell 80 Point and APF pensions

- The opportunity to purchase Shell shares through the GESPP (discounted from market prices).

With so many options, it can take some coordination and strategy to maximize your retirement planning and saving success.

Shell Professionals Can Get Over $80,000 Into Retirement Savings This Year

Learn how here.

Maximizing Retirement Benefits Through the Shell Provident Fund 401(k)

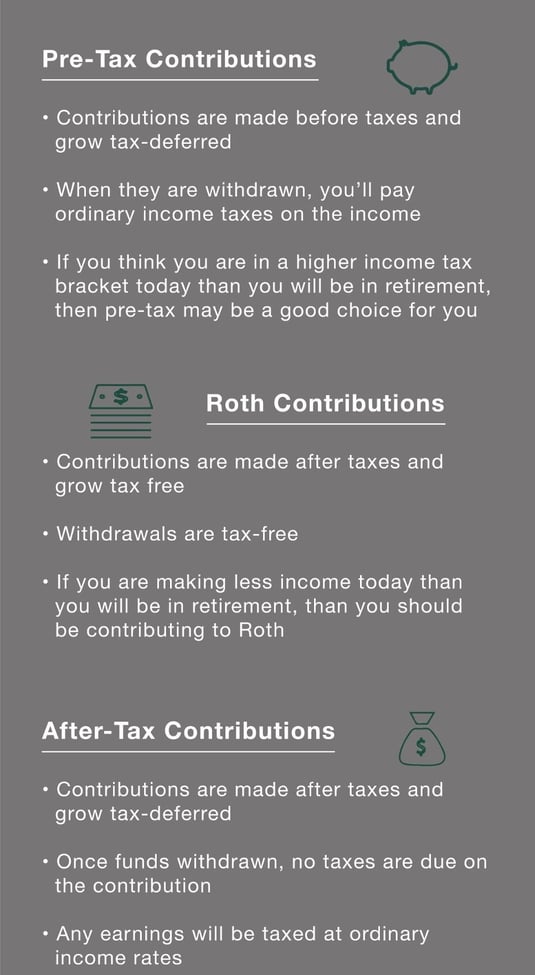

The Shell Provident Fund is Shell’s 401(k) plan. You can contribute to the plan and can do so pre-tax, after-tax, or using Roth income.

In addition, Shell contributes generously on behalf of its employees, putting between 2.5 and 10 percent of your annual cash compensation into the 401(k). The exact amount depends on your tenure with the company.

Your 401(k) contributions can increase slightly as you near retirement age. If you’re under 50, you can contribute up to $23,500 (2025) between pre-tax and Roth. If you’re over 50, you can contribute an additional catch-up amount of $7,500 for a total contribution option of $31,000 in 2025.

Should I Choose Pre-Tax, After-Tax, or Roth Contributions to the Shell Provident Fund 401(k)?

You have options when it comes to contributing to the Shell Provident Fund. Each option has its own benefits, and the best option for you will depend on your retirement plans.

Benefiting From After-Tax Rollovers Within Your Shell 401(k) Savings Options

An after-tax rollover can be a great savings strategy in conjunction with your after-tax 401(k).

Annually, you can roll the after-tax source from your 401(k) to a Roth IRA. Once the funds are in your Roth IRA, both the contributions and their earnings will grow tax-free.

This strategy can be useful for adding additional funds to your Roth IRA, especially when you’re over the income limits to contribute directly to a Roth IRA.

Income Limitations on Shell Provident Fund 401(k) Contributions

If you’re a highly compensated employee, you need to employ some additional strategic considerations when planning your annual Provident Fund contributions.

The IRS limits contributions for people who earn more than $350,000 during a calendar year. Once you reach that point, Shell will no longer contribute on your behalf.

If you expect you’ll reach that threshold, you may want to front-load your retirement contributions to maximize the funds Shell will add to your account and ensure you’re not leaving any money on the table.

For example, if Shell provides their maximum contribution to your 401(k) account, the most they can possibly give you is $35,000. If you’re a high earner, you should schedule your contributions to receive the full employer contribution before you reach the $350,000 threshold.

The Provident Fund 401(k) is a valuable retirement savings option, and contributing to it both early and with consistency allows for greater growth over time or for the possibility of earlier retirement.

Before selecting a retirement date from Shell, ensure you're not leaving any money on the table.

Learn more about the main factors to consider when selecting a Shell retirement date >

Maximizing Retirement Benefits Through Backdoor Roth Contributions

A backdoor Roth contribution is a strategy in which a non-deductible IRA contribution is made to a traditional IRA and subsequently converted to a Roth IRA.

In addition to the after-tax rollover savings strategy, as a Shell saver, you can put $7,000 (or $8,000 if over age 50) into a Roth IRA every year, even if you’re over the income limit to contribute directly.

For married couples, both spouses can make backdoor Roth contributions. If you’re also rolling over your after-tax 401(k) funds (up to $11,500 for Shell professionals this year), you can add $37,000 to your Roth IRA each year if you're both under 50 and working at Shell. There are a few stipulations and nuances tied to this strategy, including:

- You must have earned income to make an IRA contribution. (Shell performance shares can count as earned income, allowing you to continue making contributions in retirement.)

- You must not have any pre-tax money in traditional IRAs.

- You must file Form 8606 annually with your tax return.

Taking advantage of backdoor Roth contributions over several years will allow you to increase the tax-free funds you can access in retirement.

Maximizing Retirement Benefits Through Your Shell Qualified Pension

Most Shell retirees have also earned funds in a qualified pension plan.

What are Shell's Pension Plan Options?

There are two different pension fund formulas used to calculate what you’re entitled to in retirement: the 80 Point Plan and the Alternate Pension Formula (APF).

While specifically defining your pension benefits can be complicated, you do have some control over pension-related variables. For example, both years of service and Average Final Compensation (the highest-earning 36 consecutive months in your past 10 years of employment) are factors that affect your pension.

Taking these into consideration as you strategically plan your Shell retirement date can increase the benefits that are available to you. It’s important to balance your desired retirement timeline with the different retirement income sources you have available as you work to create the most solid retirement plan and asset base.

For example, if you’re expecting a generous pension based on your tenure and AFC, you may not be as concerned with maximizing 401(k) savings. Or, if your 401(k) is not where you want it to be, it can make sense to work and save an additional few years, especially if it puts you over an additional pension earning threshold.

Maximizing Retirement Benefits Through the Shell GESPP

You probably receive Shell Performance Shares as part of your bonus every year. You can also purchase additional shares of Shell stock through the Global Employee Stock Purchase Plan (GESPP).

To purchase these shares, you can contribute to the GESPP (up to $6,517 in 2024) from January to November, either in monthly increments or all at once.

Shell reviews the price of shares at the beginning of the plan year. For example, in 2023, the date was January 3, and the price was $55.98/share. Then, it reviews pricing again at the end of the plan year (the first trading day of 2024, which was January 3rd).

Your GESPP contributions will purchase shares at a 15 percent discount.

On January 3, 2024, the price of SHEL was $65.90/share. As a result, the discounted price as part of the GESPP is deducted from the lower price of the two trading days ($55.98/share on January 3, 2023), resulting in 47.58/share. Maxing out the GESPP contributions for 2023 would result in 125 purchased shares of SHEL.

It’s human nature to worry about the unknown, and retirement is certainly a big unknown. However, if you’re a Shell employee concerned about your retirement income, you can take full advantage of the savings opportunities through Shell’s robust retirement plans and benefit offerings.

It’s important to start saving in plans like the 401(k) and GESPP as early as possible to use time and market returns to your advantage. And it’s never too early to begin putting together your retirement strategy and preparing for the future.

At Willis Johnson & Associates, we have years of experience supporting Shell executives and professionals through their retirement planning efforts. We have experience with maximizing retirement saving strategies and minimizing retirement tax burdens. If you’re interested in learning how we can support you, take a look at the resources we make available to Shell employees and at the retirement planning process we use to help our clients prepare for their futures.